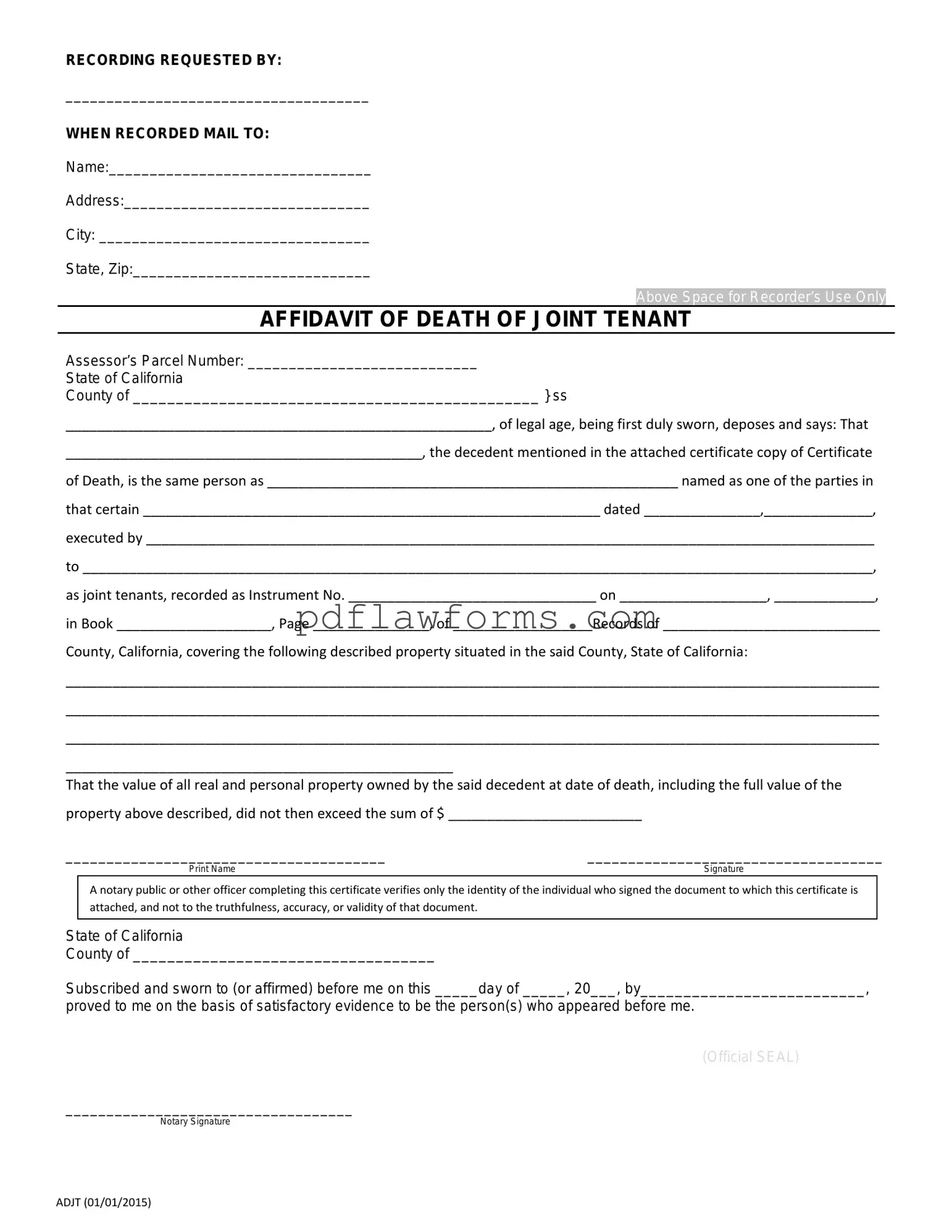

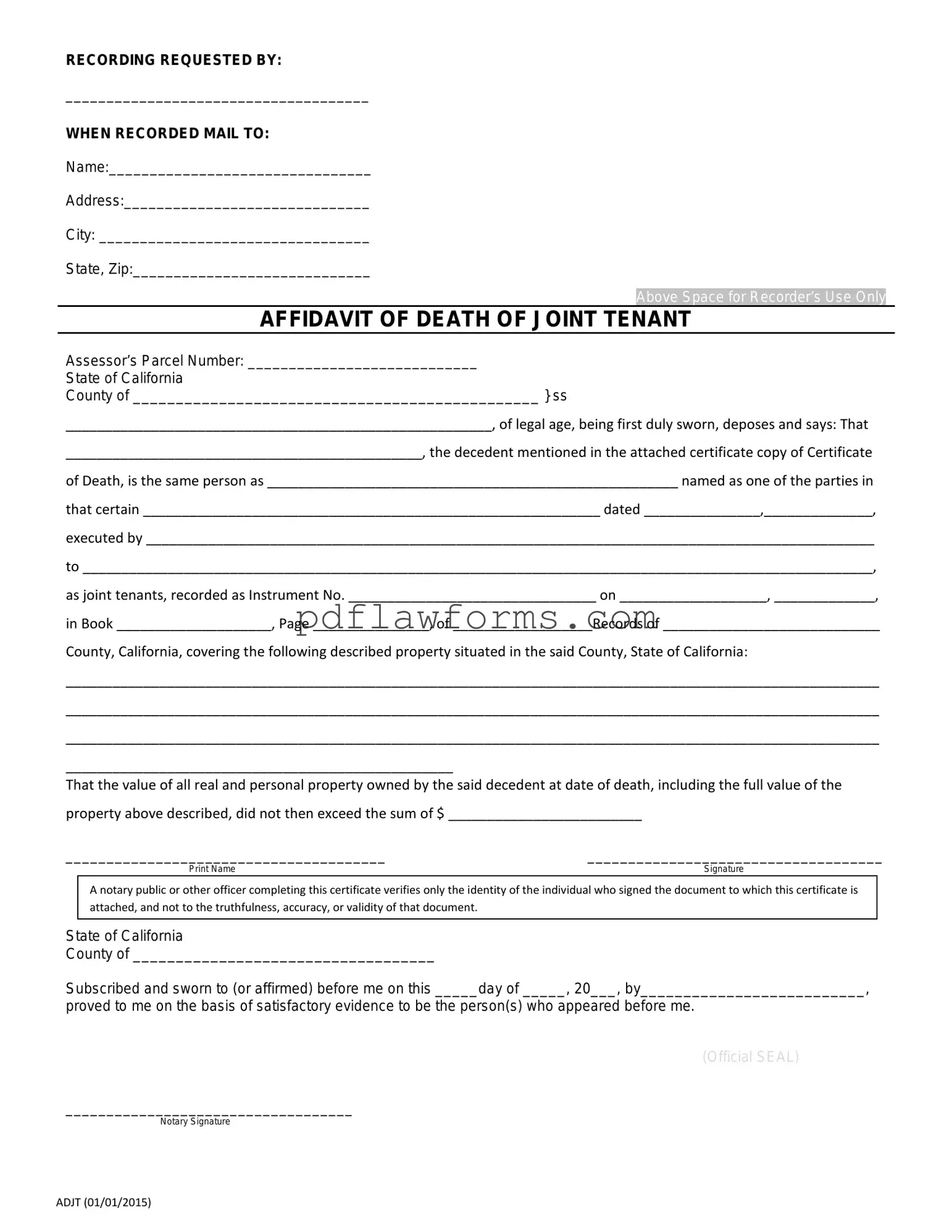

Fill Your California Death of a Joint Tenant Affidavit Template

The California Death of a Joint Tenant Affidavit form is a legal document used to transfer ownership of property when one joint tenant passes away. This form helps simplify the process for surviving tenants, ensuring that the deceased tenant's share of the property is properly handled. If you need to fill out this form, click the button below to get started.

Make My Document Online

Fill Your California Death of a Joint Tenant Affidavit Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete California Death of a Joint Tenant Affidavit online, then download your file.

Make My Document Online

or

⇩ California Death of a Joint Tenant Affidavit PDF