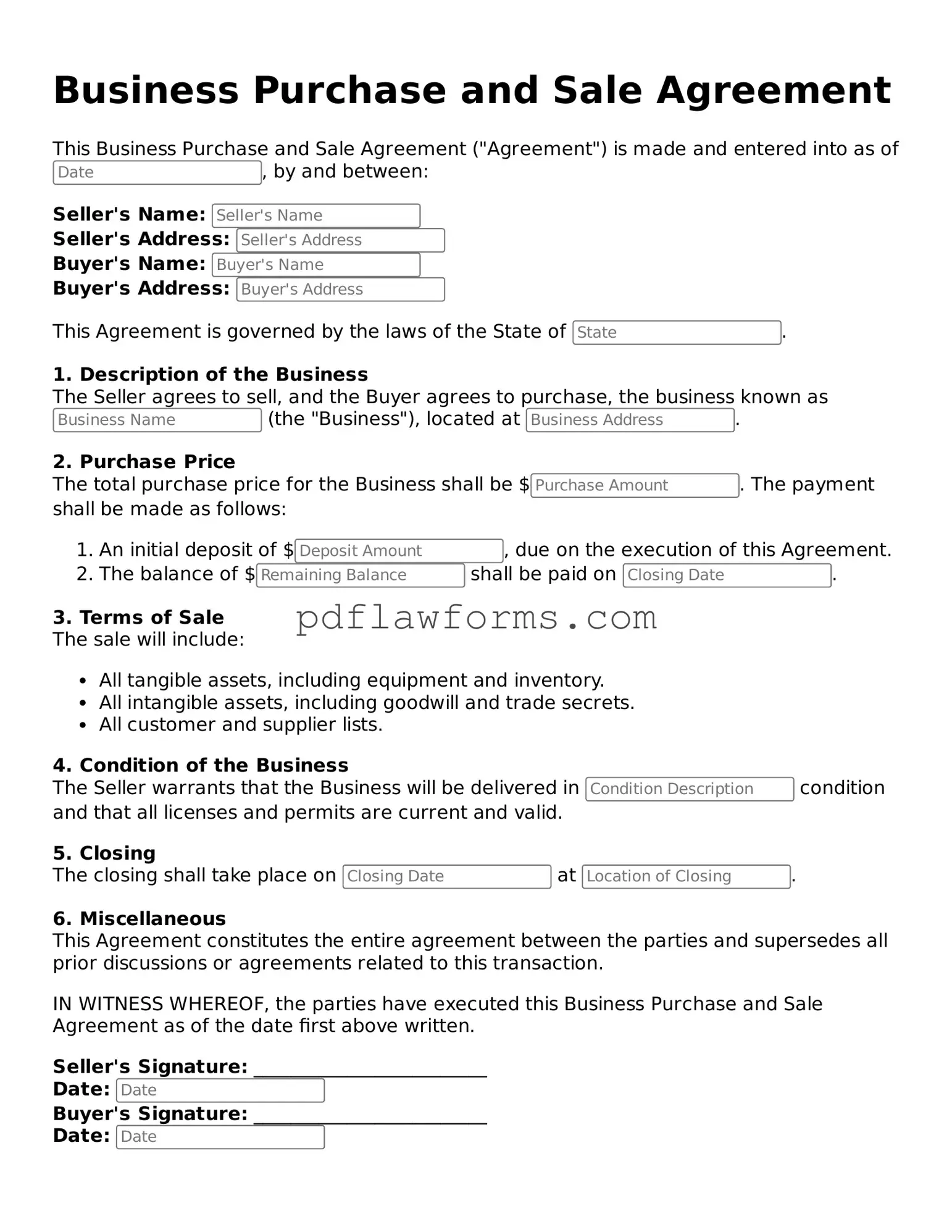

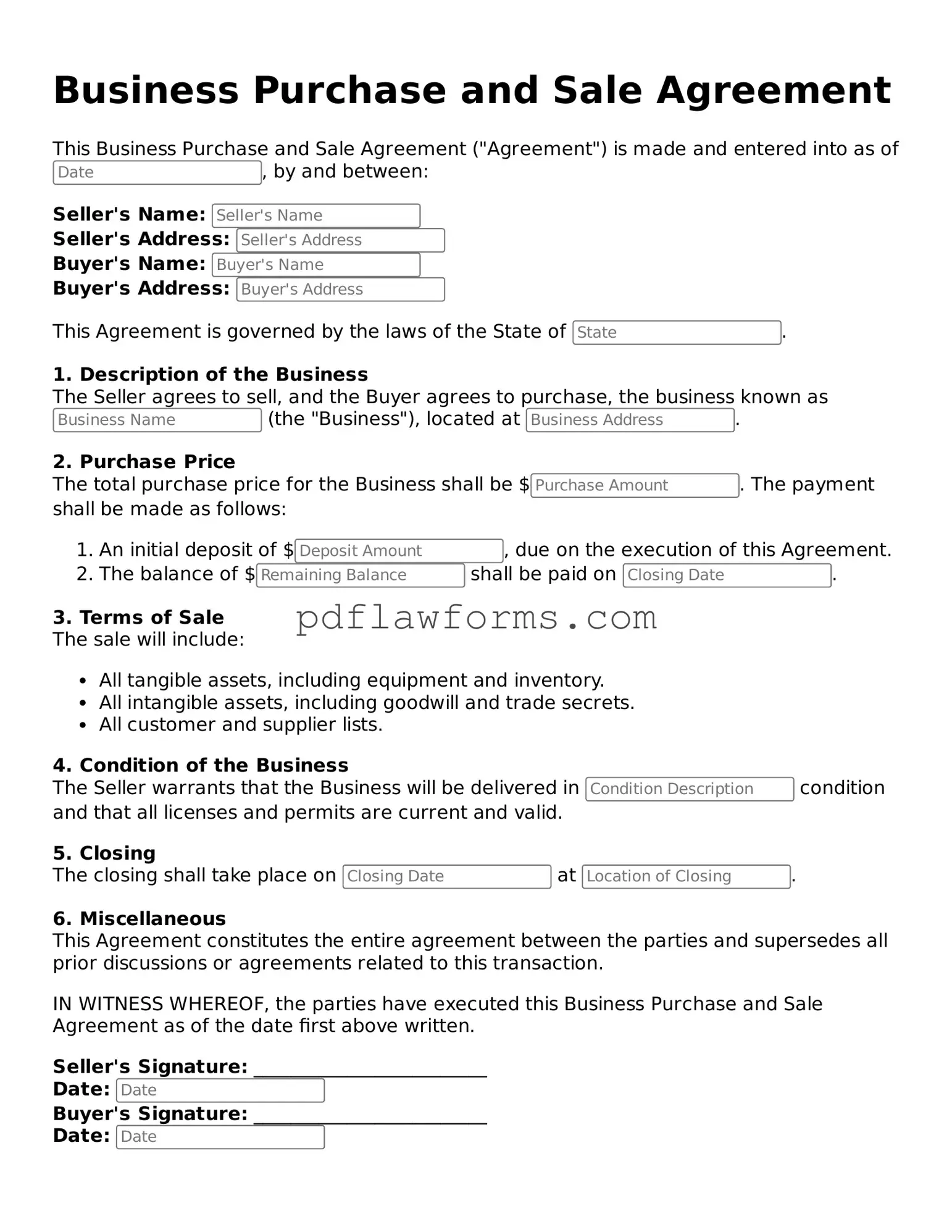

Official Business Purchase and Sale Agreement Form

The Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy a business from another. This agreement serves to protect both the buyer and seller by clearly defining the responsibilities and obligations of each party involved in the transaction. Understanding this form is essential for anyone looking to navigate the complexities of buying or selling a business.

Ready to take the next step? Fill out the form by clicking the button below.

Make My Document Online

Official Business Purchase and Sale Agreement Form

Make My Document Online

You’re halfway through — finish the form

Edit and complete Business Purchase and Sale Agreement online, then download your file.

Make My Document Online

or

⇩ Business Purchase and Sale Agreement PDF