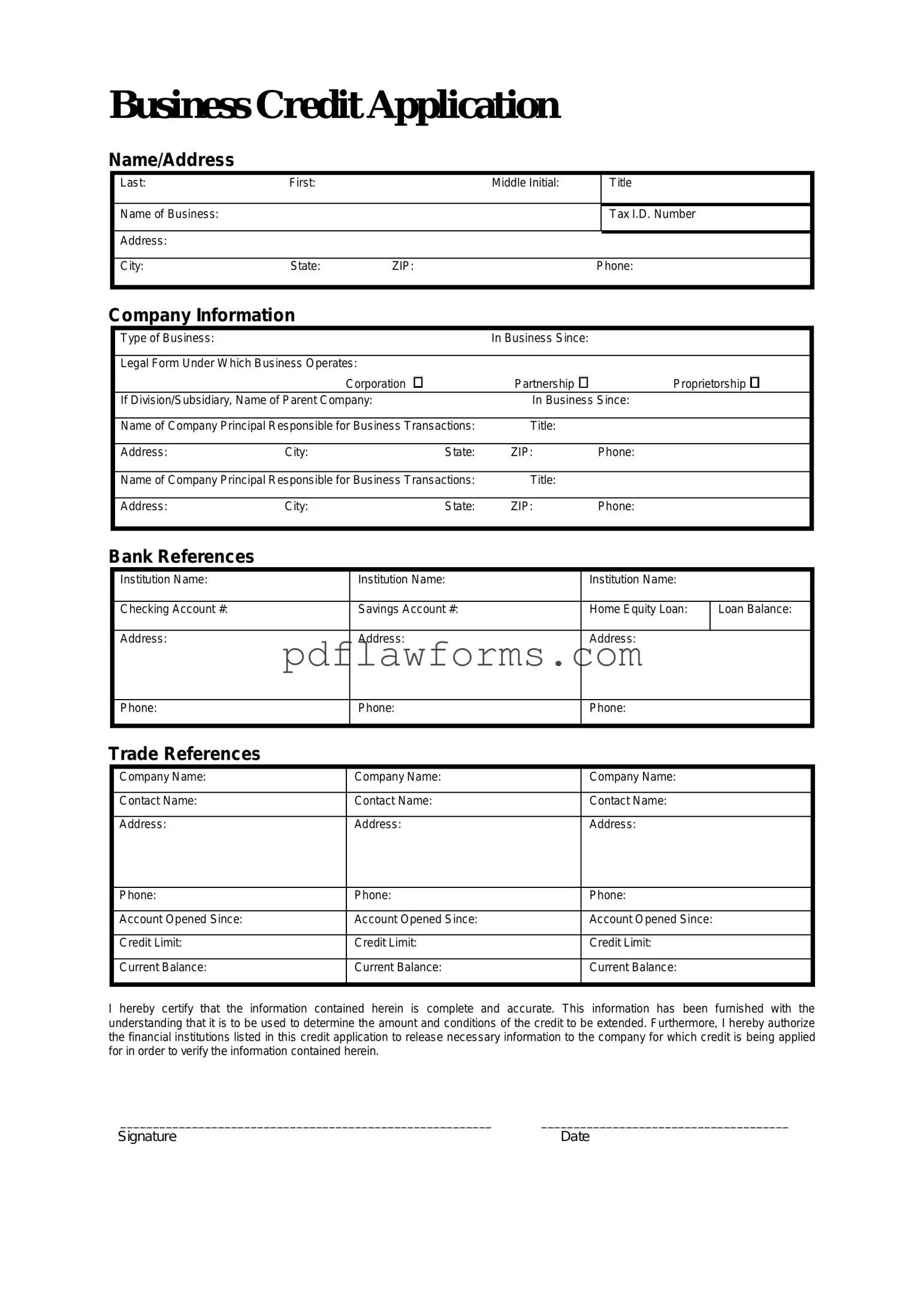

Fill Your Business Credit Application Template

The Business Credit Application form is a crucial document that businesses use to request credit from suppliers or lenders. This form collects essential information about the business's financial status and creditworthiness, helping creditors assess risk. To get started on securing credit for your business, please fill out the form by clicking the button below.

Make My Document Online

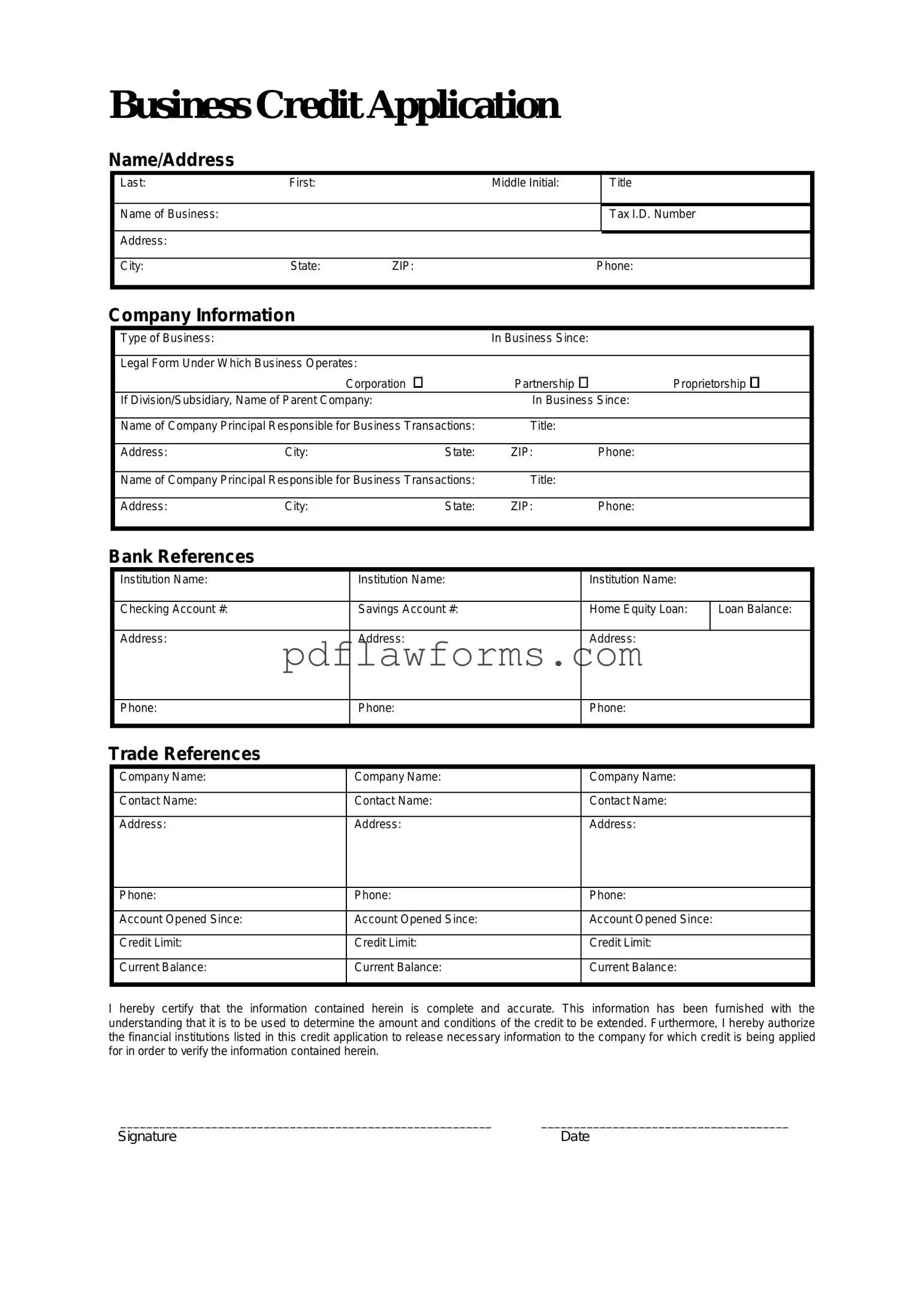

Fill Your Business Credit Application Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Business Credit Application online, then download your file.

Make My Document Online

or

⇩ Business Credit Application PDF