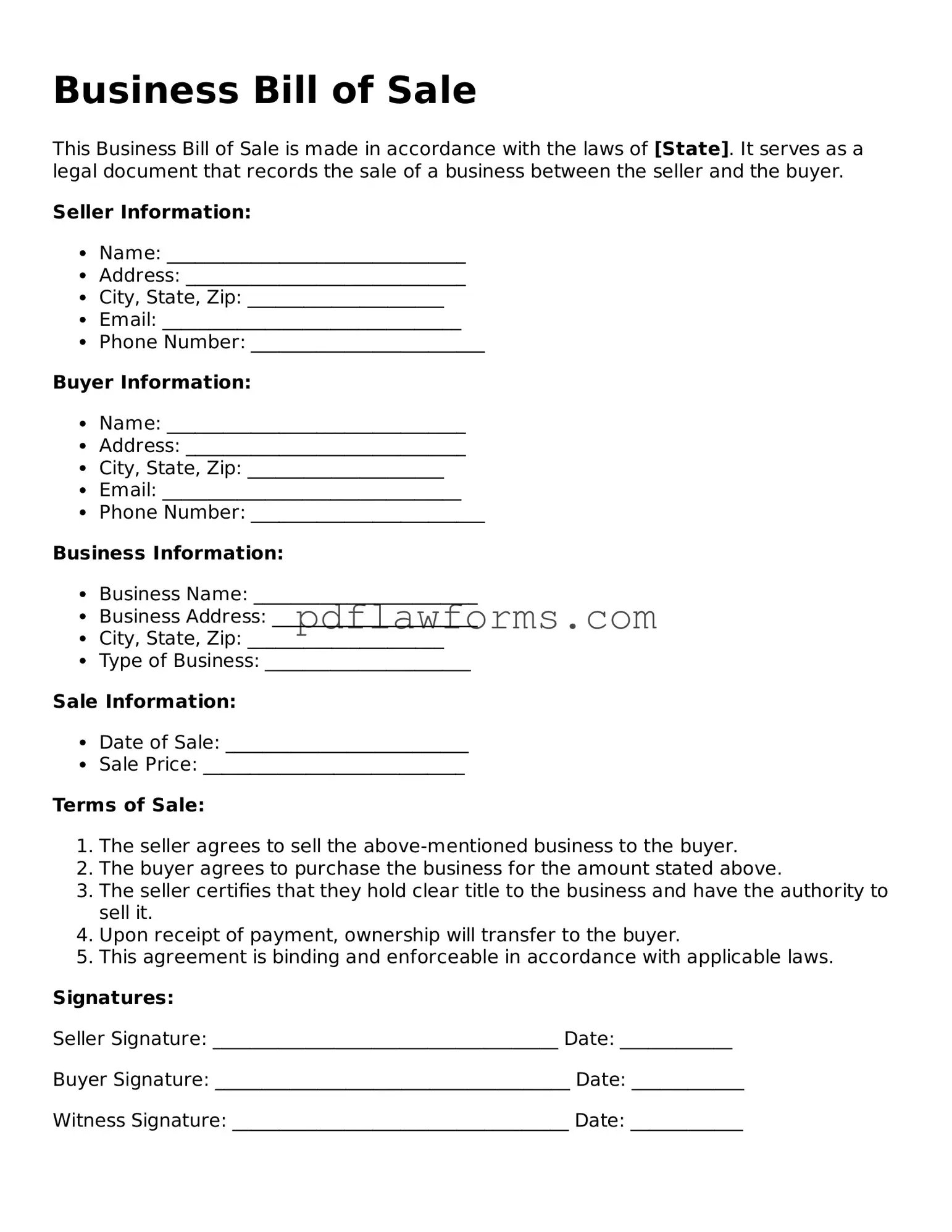

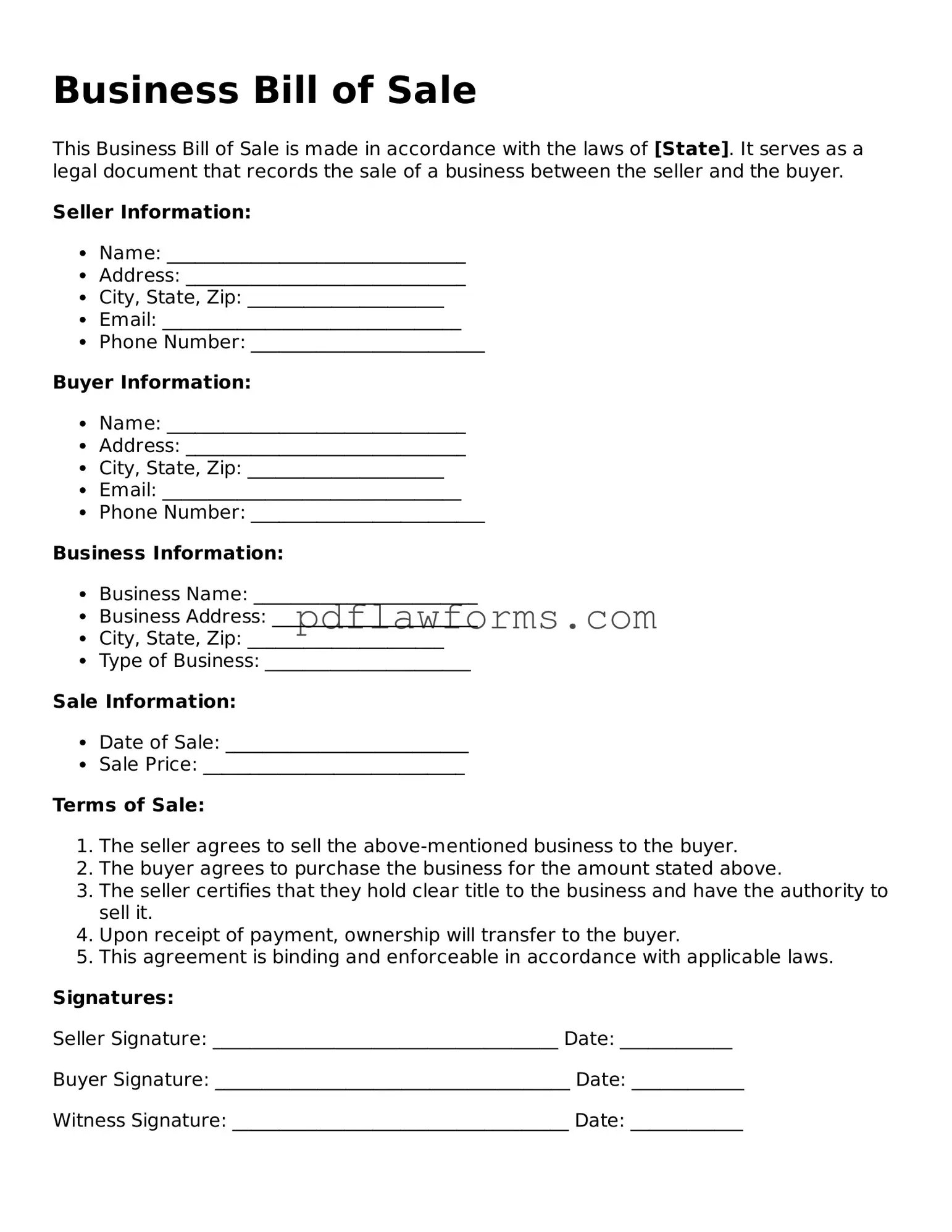

Filling out a Business Bill of Sale form is a crucial step in transferring ownership of a business. However, many people make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure a smooth transaction.

One frequent error is not providing complete information. It's essential to include all relevant details, such as the names and addresses of both the buyer and seller. Omitting this information can create confusion and may lead to disputes later on.

Another mistake is failing to accurately describe the business being sold. This includes not just the name of the business but also its assets, liabilities, and any relevant licenses or permits. A vague description can lead to misunderstandings about what is included in the sale.

People often overlook the importance of including a sales price. Without a clearly stated amount, it becomes challenging to establish the value of the transaction. This can affect everything from tax obligations to future negotiations.

Some individuals neglect to indicate the payment method. Whether the buyer is paying in cash, through financing, or with a trade, specifying the payment method is crucial. This clarity helps both parties understand their obligations and can prevent disputes.

Another common mistake is not having the document signed by both parties. A Business Bill of Sale is only valid if both the buyer and seller sign it. Failing to do so can render the document ineffective, leaving the transaction open to challenges.

People sometimes forget to date the document. Including the date of the transaction is important for legal purposes. It establishes when the ownership transfer took place and can be critical for record-keeping.

In some cases, individuals fail to consult a professional before completing the form. Legal and financial advisors can provide valuable insights and help ensure that the document meets all necessary requirements. Skipping this step can lead to costly mistakes.

Another mistake is not keeping a copy of the completed form. Once the transaction is finalized, it’s vital to retain a copy for your records. This can be useful for future reference, especially if questions arise about the sale.

Finally, people may ignore local laws and regulations. Each state has its own requirements for a Business Bill of Sale. Familiarizing yourself with these rules can prevent legal issues that may arise from non-compliance.

By being aware of these common mistakes, individuals can navigate the process of completing a Business Bill of Sale more effectively. Attention to detail and a proactive approach can lead to a successful business transaction.