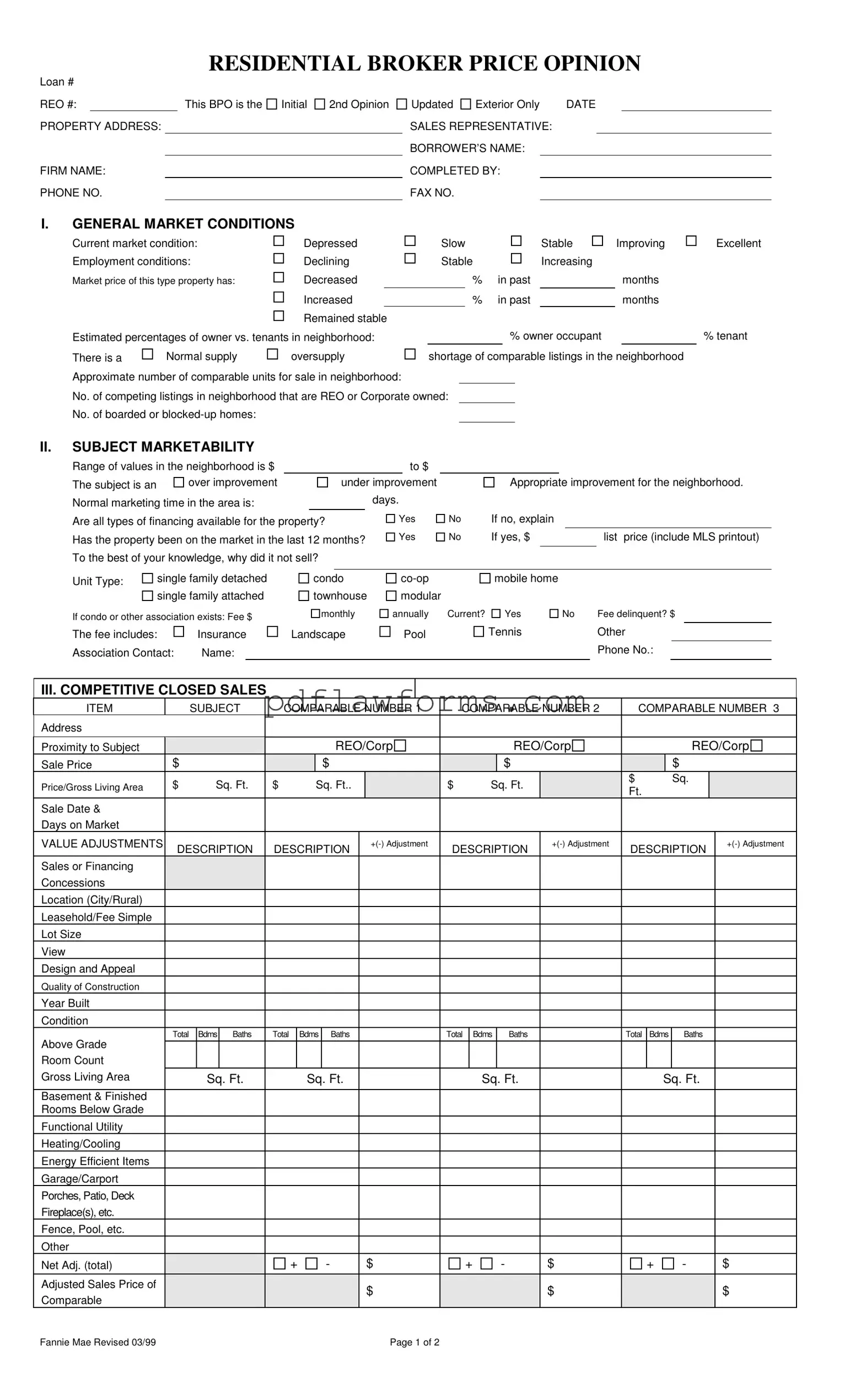

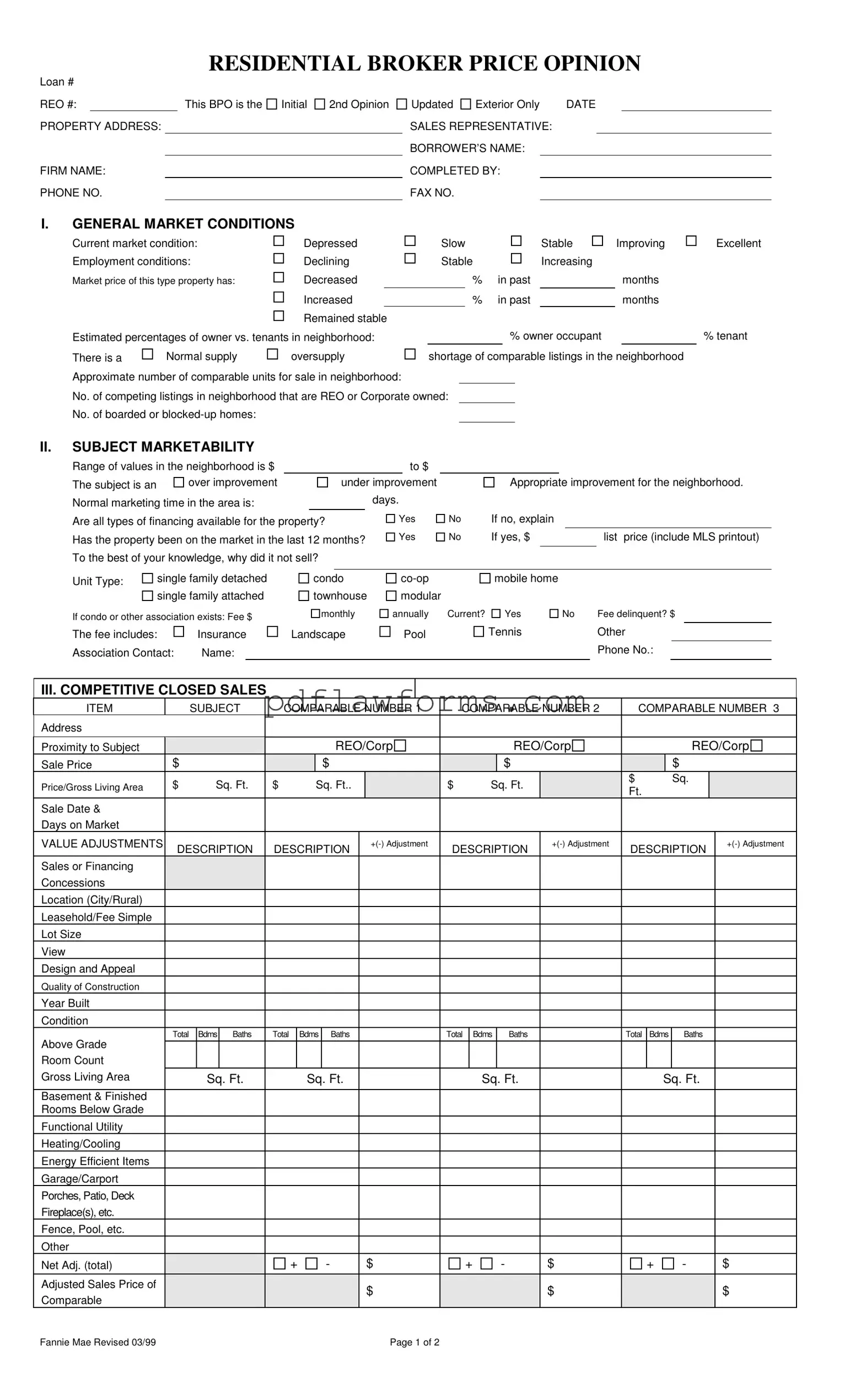

Fill Your Broker Price Opinion Template

A Broker Price Opinion (BPO) is an assessment provided by a real estate professional to estimate the value of a property. This form captures essential information about the property, market conditions, and comparable sales to inform potential buyers and sellers. To begin the process of determining a property's value, please fill out the BPO form by clicking the button below.

Make My Document Online

Fill Your Broker Price Opinion Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Broker Price Opinion online, then download your file.

Make My Document Online

or

⇩ Broker Price Opinion PDF