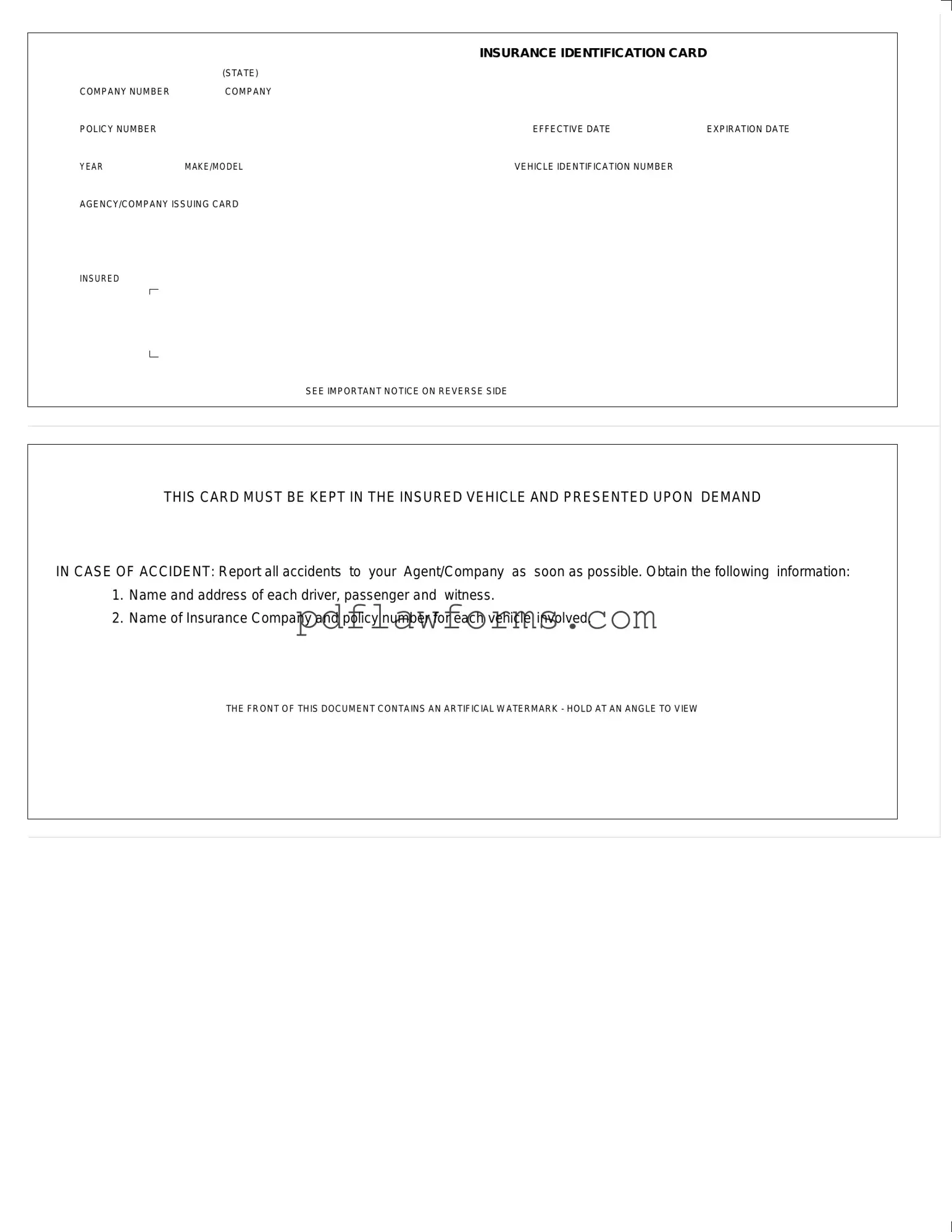

Filling out an Auto Insurance Card form can seem straightforward, yet many individuals make common mistakes that can lead to complications later on. One frequent error occurs when people neglect to include the insurance identification card company number. This number is crucial for identifying the insurance provider and ensuring that the coverage is valid. Without it, the card may be deemed incomplete, potentially leading to issues during a claim or when pulled over by law enforcement.

Another mistake involves failing to update the effective date and expiration date of the policy. These dates indicate when the insurance coverage starts and ends. If the dates are incorrect, it can create confusion about whether the vehicle is insured at the time of an accident or traffic stop. Always double-check these dates to avoid unnecessary complications.

Many individuals also overlook the importance of accurately entering the vehicle identification number (VIN). This unique number identifies the vehicle and ensures that the insurance policy covers the correct car. Errors in the VIN can lead to coverage disputes, especially if the vehicle is involved in an accident.

Some people mistakenly fill in the year, make, and model of their vehicle incorrectly. These details are essential for the insurance company to assess risk and provide accurate coverage. Providing incorrect information may result in higher premiums or even denial of coverage if the vehicle is not as described.

Additionally, failing to include the name of the agency or company issuing the card can lead to confusion. This information is vital for anyone who needs to verify the insurance coverage. If this detail is missing, it may cause delays in processing claims or inquiries.

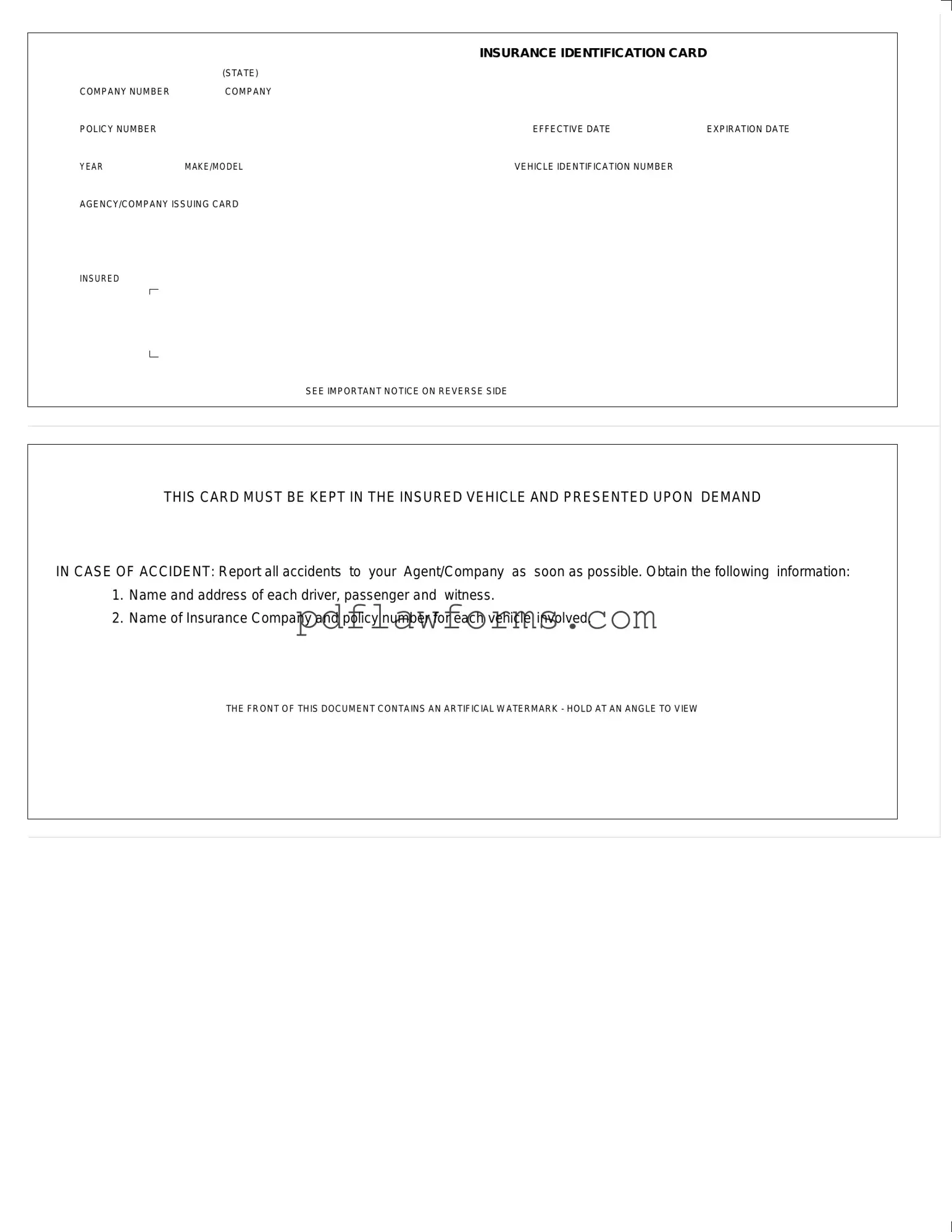

Another common oversight is neglecting to keep the card in the vehicle. The instructions clearly state that the card must be kept in the insured vehicle and presented upon demand. Forgetting this step can lead to fines or complications during a traffic stop or accident.

People often ignore the important notice on the reverse side of the card. This notice typically contains crucial information regarding what to do in case of an accident, including reporting procedures. Not following these guidelines can hinder the claims process and create additional stress during an already difficult situation.

Some individuals fail to report all necessary details after an accident, such as the names and addresses of drivers, passengers, and witnesses involved. Missing this information can complicate the claims process and may even result in a denial of the claim.

Another mistake is not keeping a copy of the completed form for personal records. This can be problematic if there are disputes regarding coverage or if the card is lost. Having a copy ensures that you have the necessary information readily available when needed.

Finally, individuals sometimes forget to review the completed form for accuracy before submission. Taking a moment to double-check all entries can save time and prevent potential issues down the line. Simple errors can lead to significant problems, so a thorough review is always advisable.