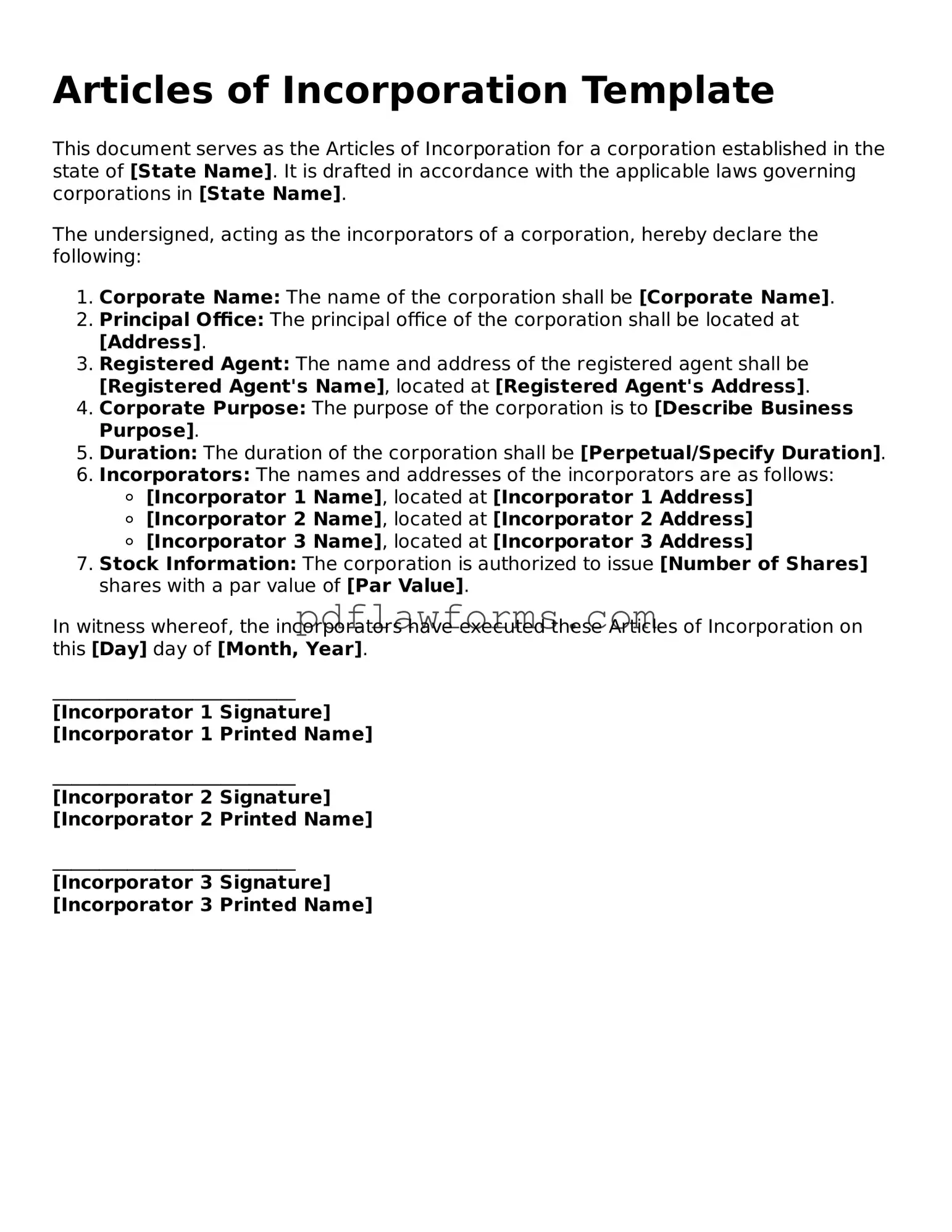

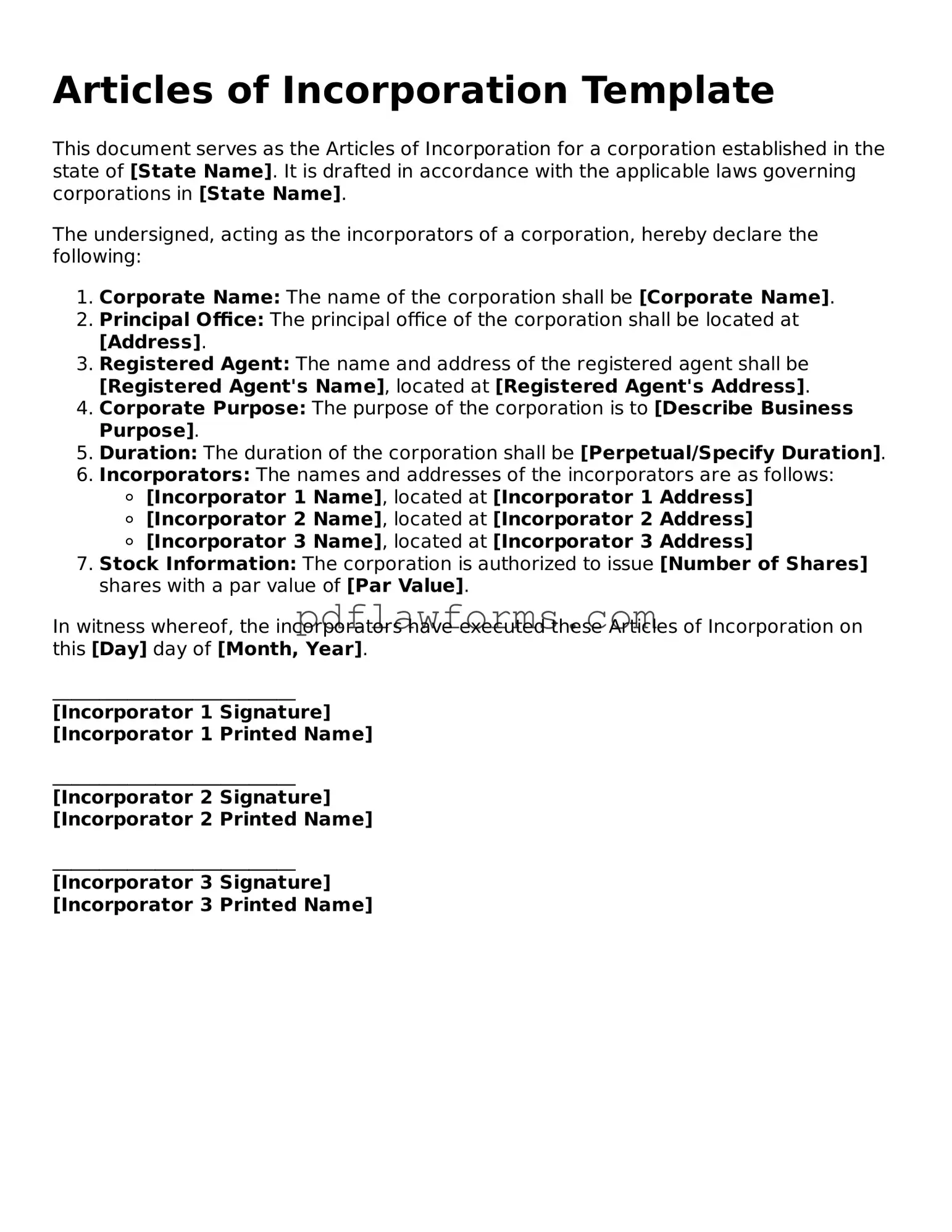

Filling out the Articles of Incorporation is a crucial step for anyone looking to establish a corporation. However, many individuals make common mistakes that can lead to delays or complications in the incorporation process. Awareness of these pitfalls can help ensure a smoother experience.

One frequent error is incomplete information. Some people forget to provide all necessary details, such as the corporation's name or the registered agent's address. Omitting even a single piece of information can result in the rejection of the application. It's essential to double-check that every section of the form is filled out completely.

Another mistake involves choosing an unavailable name for the corporation. Each state has specific rules regarding business names, and if someone selects a name already in use or too similar to an existing entity, the application will be denied. Conducting a thorough name search before filling out the form can prevent this issue.

Many individuals also neglect to include the correct purpose of the corporation. The purpose statement should clearly outline what the corporation intends to do. Vague descriptions can lead to confusion and may require additional clarification from state officials.

Additionally, some applicants forget to designate a registered agent. A registered agent is a person or entity designated to receive legal documents on behalf of the corporation. Without this crucial designation, the application may not be processed, leading to unnecessary delays.

Another common oversight is not adhering to state-specific requirements. Each state has its own rules regarding the Articles of Incorporation. Failing to comply with these regulations can result in the rejection of the application. It's vital to review the specific requirements for the state in which the corporation is being formed.

Some people also make the mistake of not including the appropriate fees. Each state charges a fee for processing the Articles of Incorporation, and failure to include payment can halt the process. Ensure that the correct amount is submitted along with the application to avoid any setbacks.

Inaccurate or unclear information about the incorporators is another common issue. The names and addresses of the incorporators must be provided accurately. Errors in this section can lead to confusion and may require additional documentation to clarify ownership and responsibility.

Many applicants also overlook the importance of signatures. The Articles of Incorporation must be signed by the incorporators. A missing signature can result in the application being deemed invalid. It’s crucial to ensure that all required signatures are present before submission.

Finally, some individuals fail to keep copies of submitted documents. Having a copy of the Articles of Incorporation and any accompanying documents can be invaluable for future reference. It’s wise to maintain organized records of all submitted paperwork to track the incorporation process effectively.

By being aware of these common mistakes, individuals can navigate the process of completing the Articles of Incorporation with greater confidence and accuracy. Taking the time to review each section carefully can save time, money, and frustration in the long run.