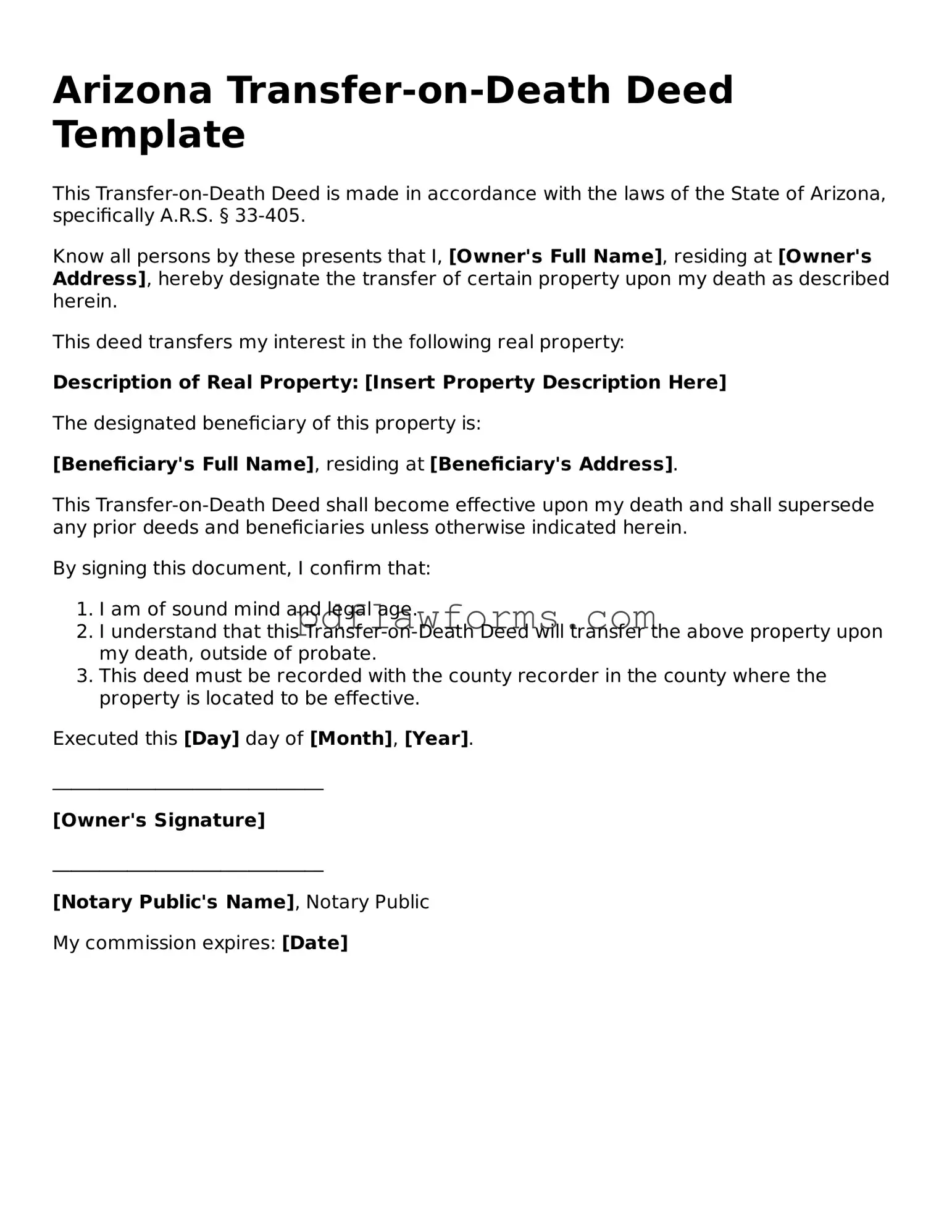

Transfer-on-Death Deed Form for the State of Arizona

The Arizona Transfer-on-Death Deed form is a legal document that allows property owners to designate beneficiaries who will automatically receive their property upon the owner's death, bypassing the probate process. This simple yet powerful tool can provide peace of mind and ensure that your wishes are honored. If you're considering this option, take action now by filling out the form below.

Make My Document Online

Transfer-on-Death Deed Form for the State of Arizona

Make My Document Online

You’re halfway through — finish the form

Edit and complete Transfer-on-Death Deed online, then download your file.

Make My Document Online

or

⇩ Transfer-on-Death Deed PDF