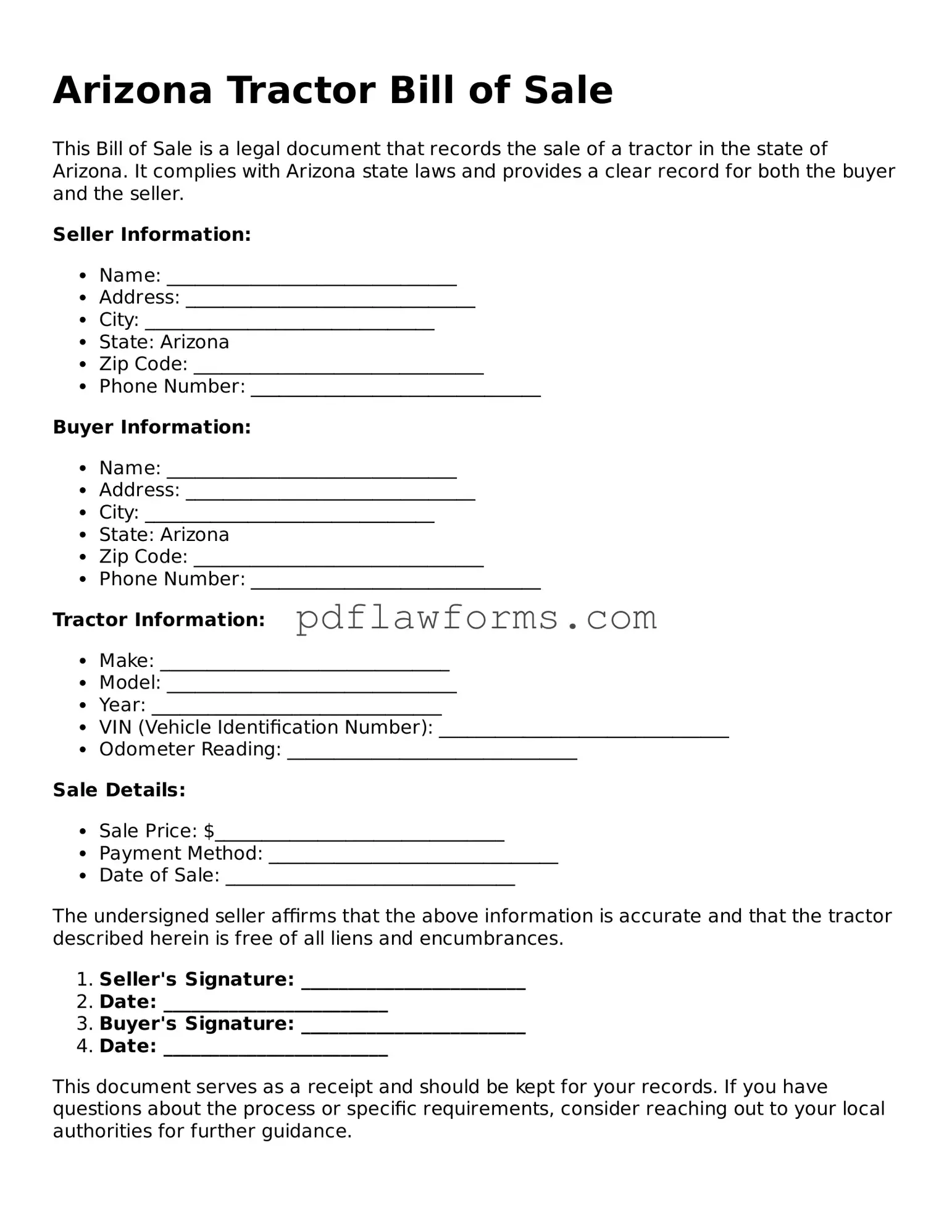

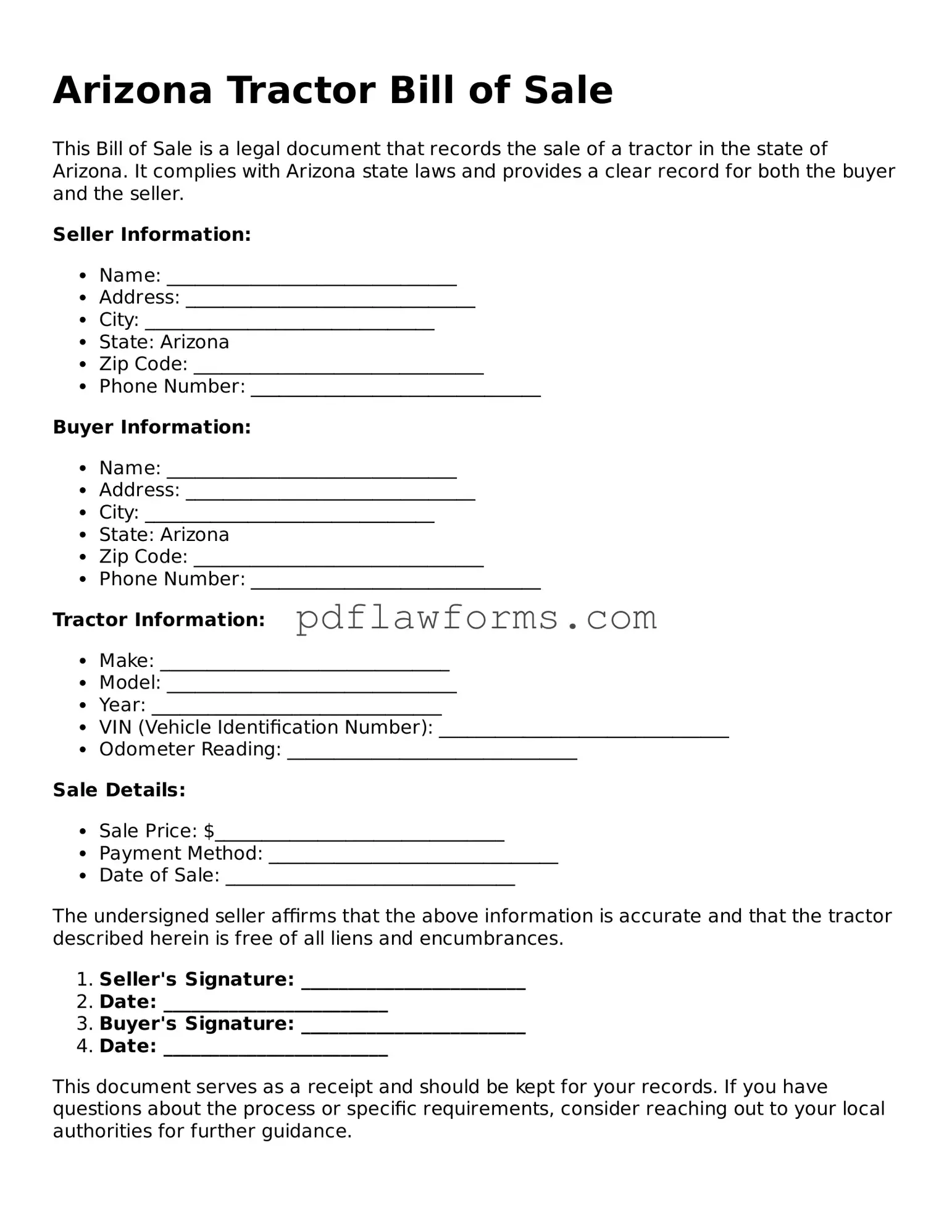

Tractor Bill of Sale Form for the State of Arizona

The Arizona Tractor Bill of Sale form is a legal document that facilitates the transfer of ownership of a tractor from one party to another within the state of Arizona. This form serves as a crucial record of the transaction, detailing important information such as the buyer and seller's names, the tractor's specifications, and the agreed-upon sale price. Completing this form accurately is essential for ensuring a smooth transfer of ownership and protecting both parties involved.

Ready to fill out your Arizona Tractor Bill of Sale? Click the button below to get started!

Make My Document Online

Tractor Bill of Sale Form for the State of Arizona

Make My Document Online

You’re halfway through — finish the form

Edit and complete Tractor Bill of Sale online, then download your file.

Make My Document Online

or

⇩ Tractor Bill of Sale PDF