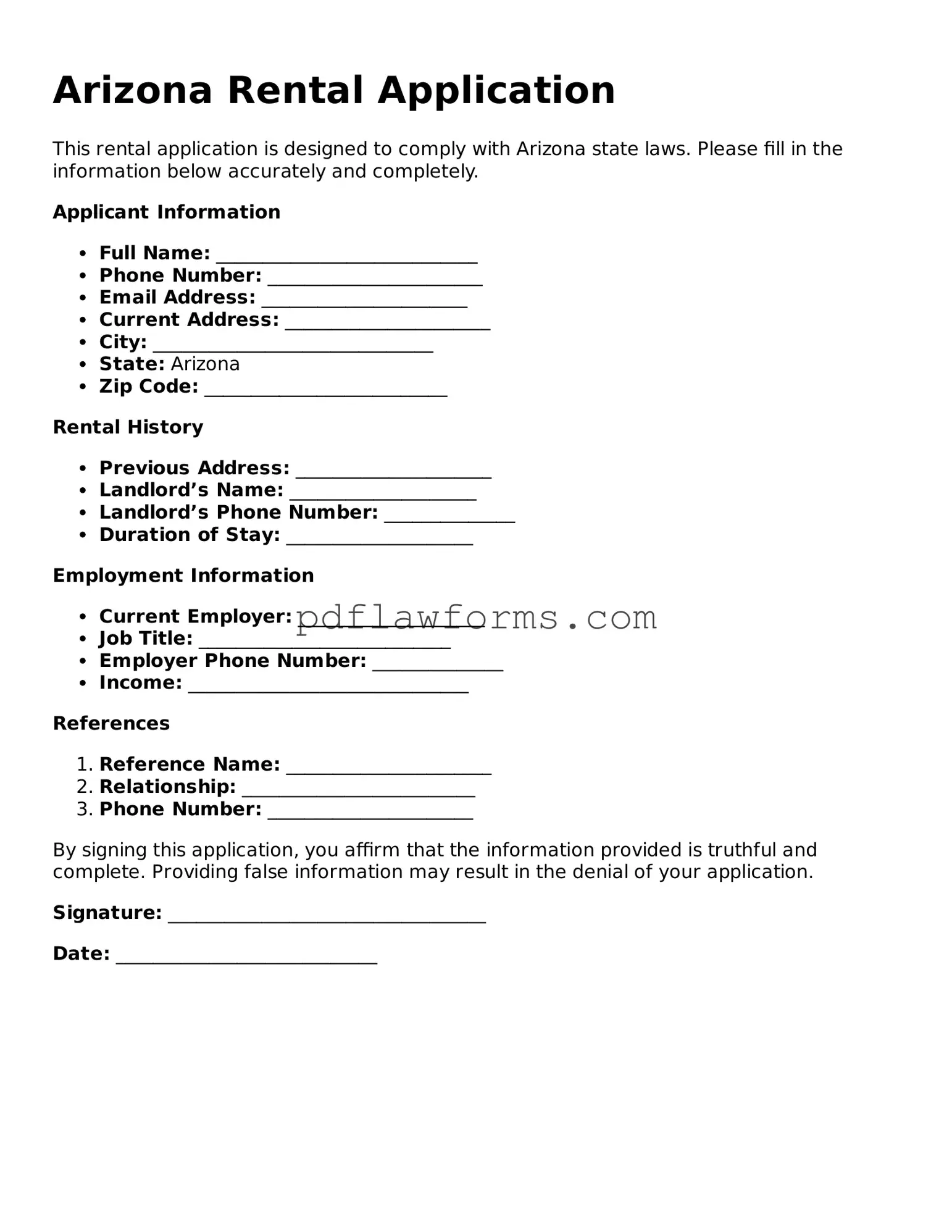

Filling out a rental application can seem straightforward, but many people make common mistakes that can jeopardize their chances of securing a lease. One frequent error is incomplete information. Applicants often forget to fill in all required fields or provide vague answers. Landlords rely on this information to assess potential tenants, so providing comprehensive and accurate details is crucial.

Another mistake involves failing to disclose relevant financial information. Some applicants may be hesitant to share their income or credit history, thinking it might hurt their chances. However, transparency is key. Landlords need to understand an applicant's financial situation to make informed decisions. Omitting this information can lead to distrust and potentially disqualify an applicant.

Additionally, many people overlook the importance of checking for errors in their application. Typos, misspellings, or incorrect contact information can create confusion. A simple mistake in a phone number or email address can delay communication or result in missed opportunities. It’s always wise to proofread before submission.

Some applicants also fail to provide references or do not inform their references that they might be contacted. References can play a significant role in a landlord’s decision-making process. By neglecting to list reliable references or failing to prepare them, applicants may inadvertently weaken their application.

Another common pitfall is not understanding the rental history section. Some individuals may think it is acceptable to skip this part if they are first-time renters. However, landlords often seek to verify rental history to gauge responsibility. First-time renters should consider including personal references or other relevant experiences that demonstrate reliability.

Moreover, many applicants do not research the property or the landlord before applying. Understanding the rental market and the specific property can provide insights that are beneficial during the application process. This knowledge can also help applicants tailor their applications to better fit the landlord’s expectations.

Another mistake is underestimating the importance of a cover letter. A well-crafted cover letter can set an applicant apart from others. It provides an opportunity to express enthusiasm for the property and explain any unique circumstances that may not be evident in the application form. Ignoring this opportunity can mean missing out on a chance to make a personal connection.

Lastly, applicants often forget to follow up after submitting their application. A polite follow-up can demonstrate interest and initiative. It also allows applicants to address any questions the landlord may have, reinforcing their commitment to securing the rental. Not reaching out can leave landlords with unanswered questions and potentially lead to missed opportunities.