Fill Your Alabama Mvt 20 1 Template

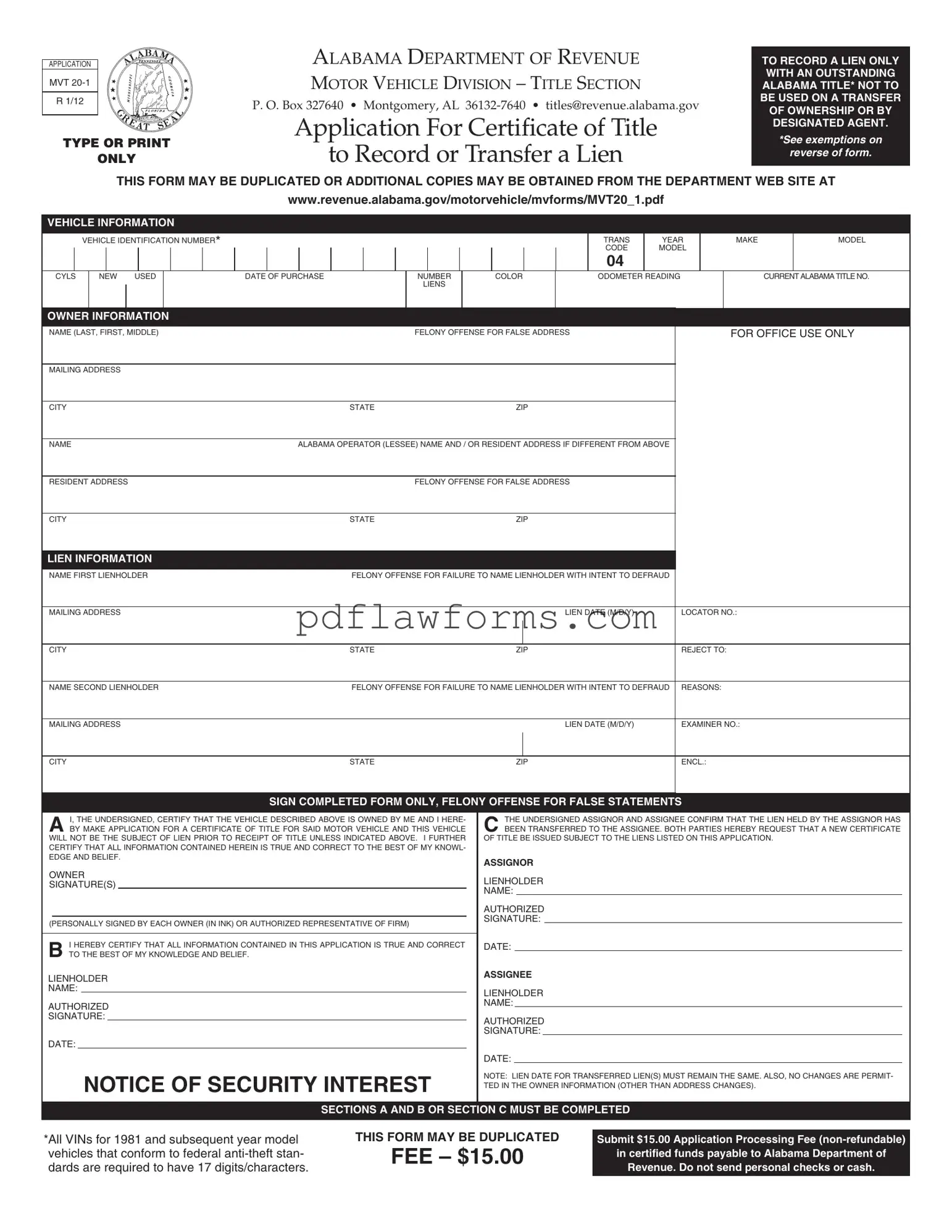

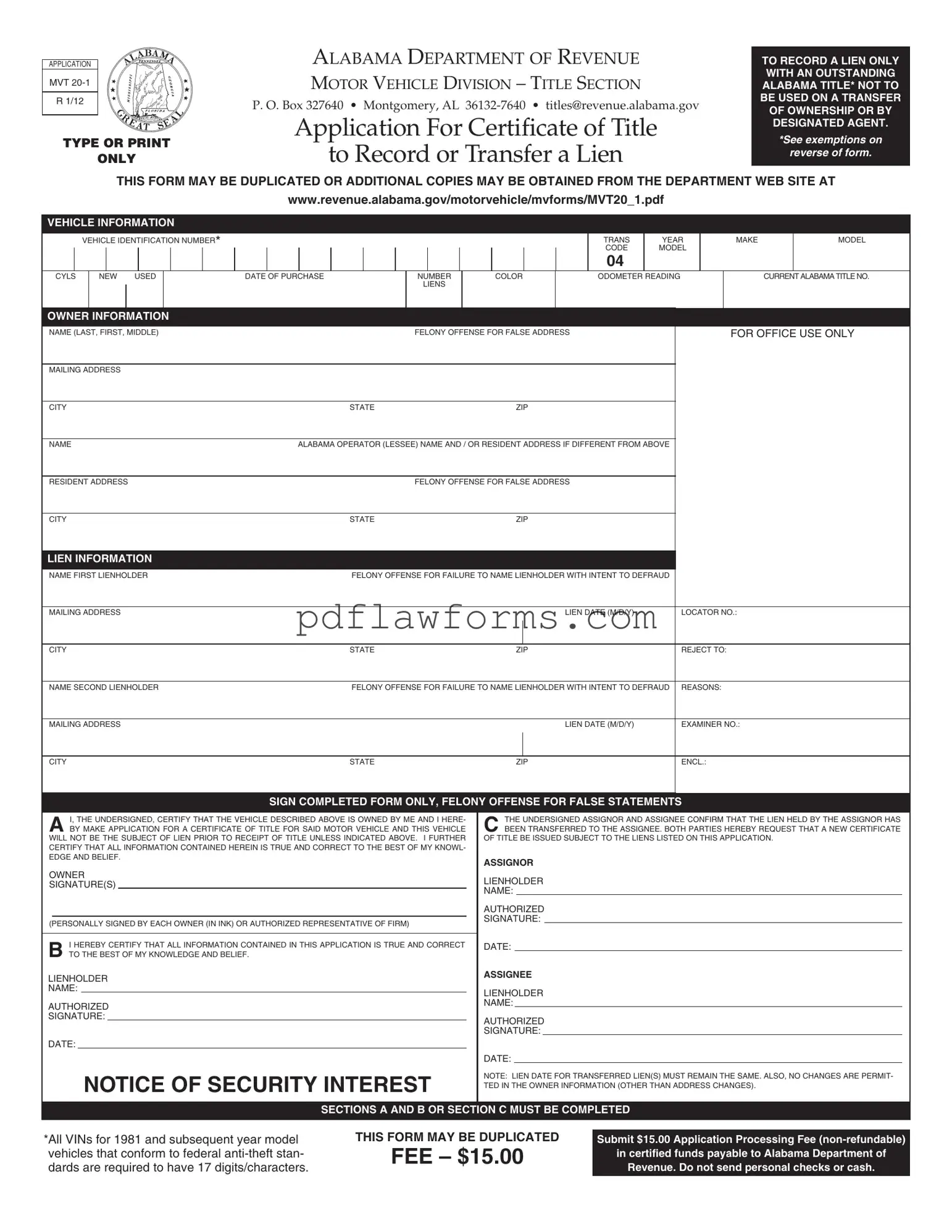

The Alabama Mvt 20 1 form is an application used to record or transfer a lien on a vehicle that has an outstanding Alabama title. This form is specifically designed for lienholders and should not be used for transferring ownership or by designated agents. For those needing to complete this form, click the button below to get started.

Make My Document Online

Fill Your Alabama Mvt 20 1 Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Alabama Mvt 20 1 online, then download your file.

Make My Document Online

or

⇩ Alabama Mvt 20 1 PDF