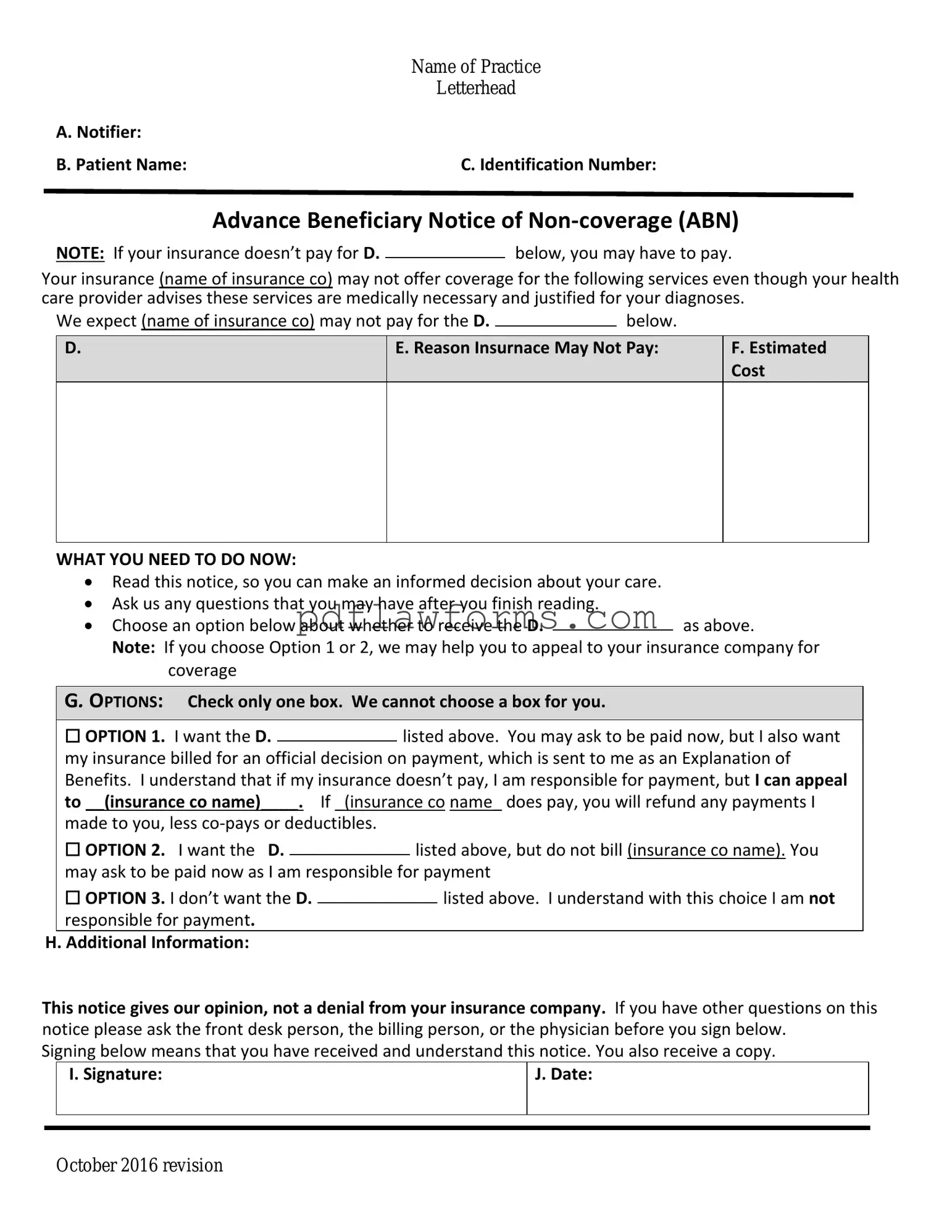

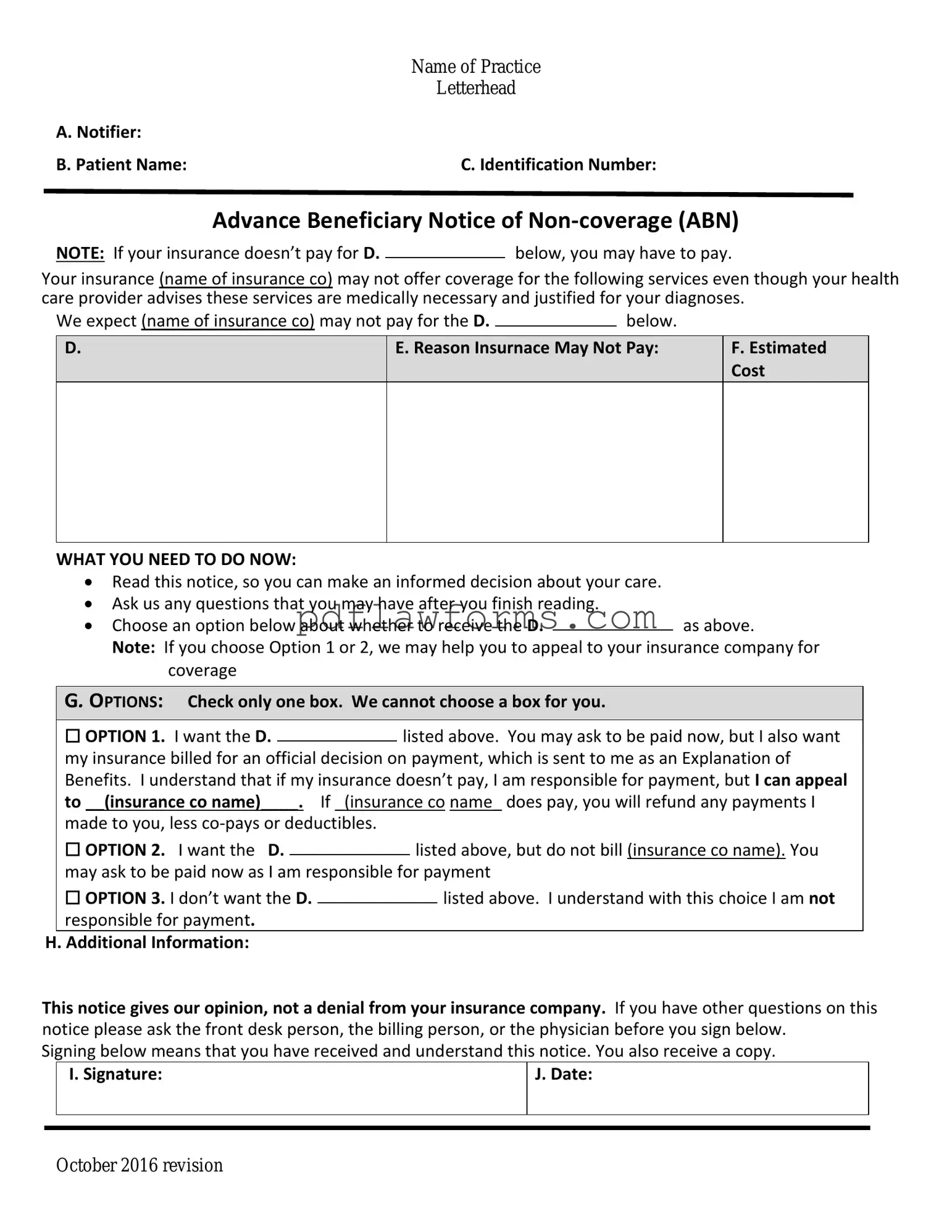

Fill Your Advance Beneficiary Notice of Non-coverage Template

The Advance Beneficiary Notice of Non-coverage (ABN) is a critical document that informs Medicare beneficiaries when a service may not be covered. This form helps patients understand their potential financial responsibilities before receiving care. To ensure you are prepared, consider filling out the ABN by clicking the button below.

Make My Document Online

Fill Your Advance Beneficiary Notice of Non-coverage Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Advance Beneficiary Notice of Non-coverage online, then download your file.

Make My Document Online

or

⇩ Advance Beneficiary Notice of Non-coverage PDF