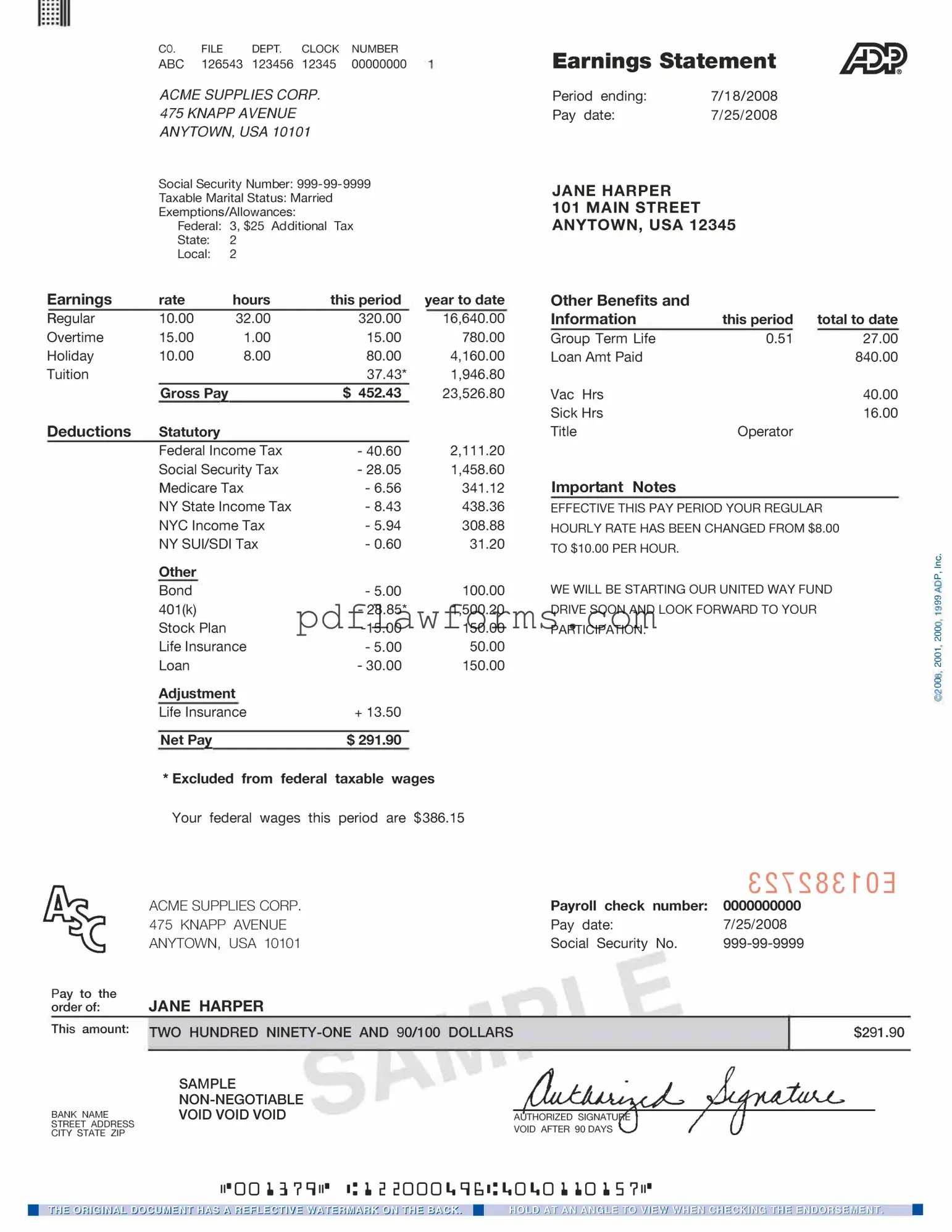

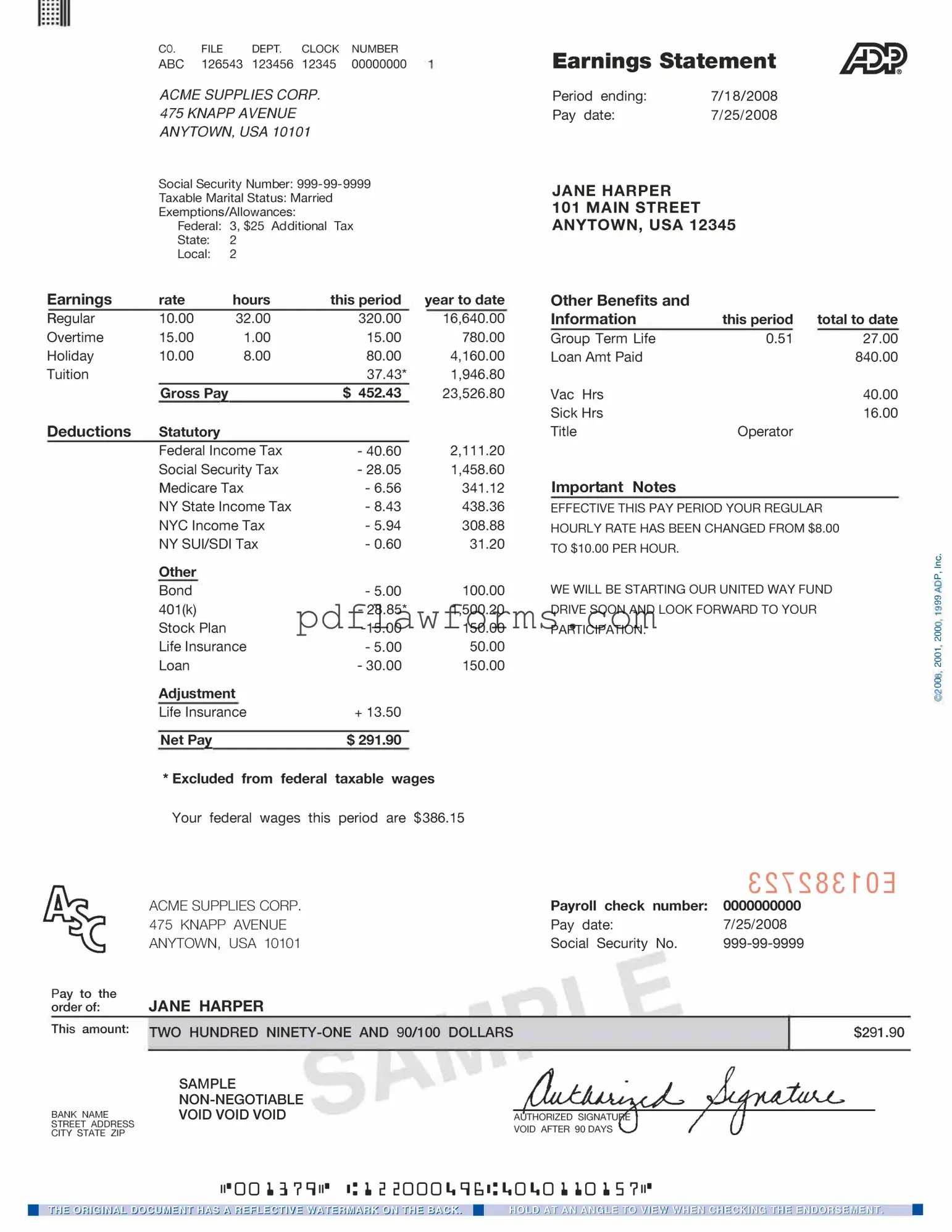

Filling out the ADP Pay Stub form can be a straightforward process, but mistakes are common. One frequent error is providing incorrect personal information. This includes misspellings of names or wrong addresses. Such inaccuracies can lead to delays in receiving important documents or payments.

Another common mistake involves the selection of the payment frequency. Many people overlook this detail, which can result in discrepancies in pay calculations. It’s crucial to ensure that the payment frequency matches the employer’s payroll schedule to avoid confusion.

Additionally, some individuals fail to check their tax withholding information. Incorrect tax deductions can lead to unexpected tax liabilities or refunds at the end of the year. Review this section carefully to ensure the right amounts are being withheld.

People often underestimate the importance of accurately reporting hours worked. Whether it’s overtime or regular hours, any errors here can affect total earnings. Double-checking hours before submission can save a lot of trouble later.

Another mistake is neglecting to verify deductions. This includes health insurance premiums, retirement contributions, and other withholdings. If these deductions are not correctly noted, it can lead to misunderstandings about take-home pay.

Some individuals forget to update their information when there are changes in their employment status. Promotions, changes in job titles, or changes in benefits can all impact the pay stub. Keeping this information current is essential for accurate pay stubs.

Failing to keep a copy of the completed form is a mistake that can have long-term consequences. Without a record, it becomes challenging to resolve discrepancies or track changes over time. Always retain a copy for personal records.

Moreover, individuals sometimes overlook the importance of reviewing the entire pay stub for errors after submission. Taking a moment to review the final document can help catch mistakes that may have been missed earlier in the process.

Lastly, not asking for help when needed can lead to errors. If there’s confusion about any section of the ADP Pay Stub form, reaching out for clarification is essential. Employers or HR representatives are typically willing to assist in ensuring the form is filled out correctly.