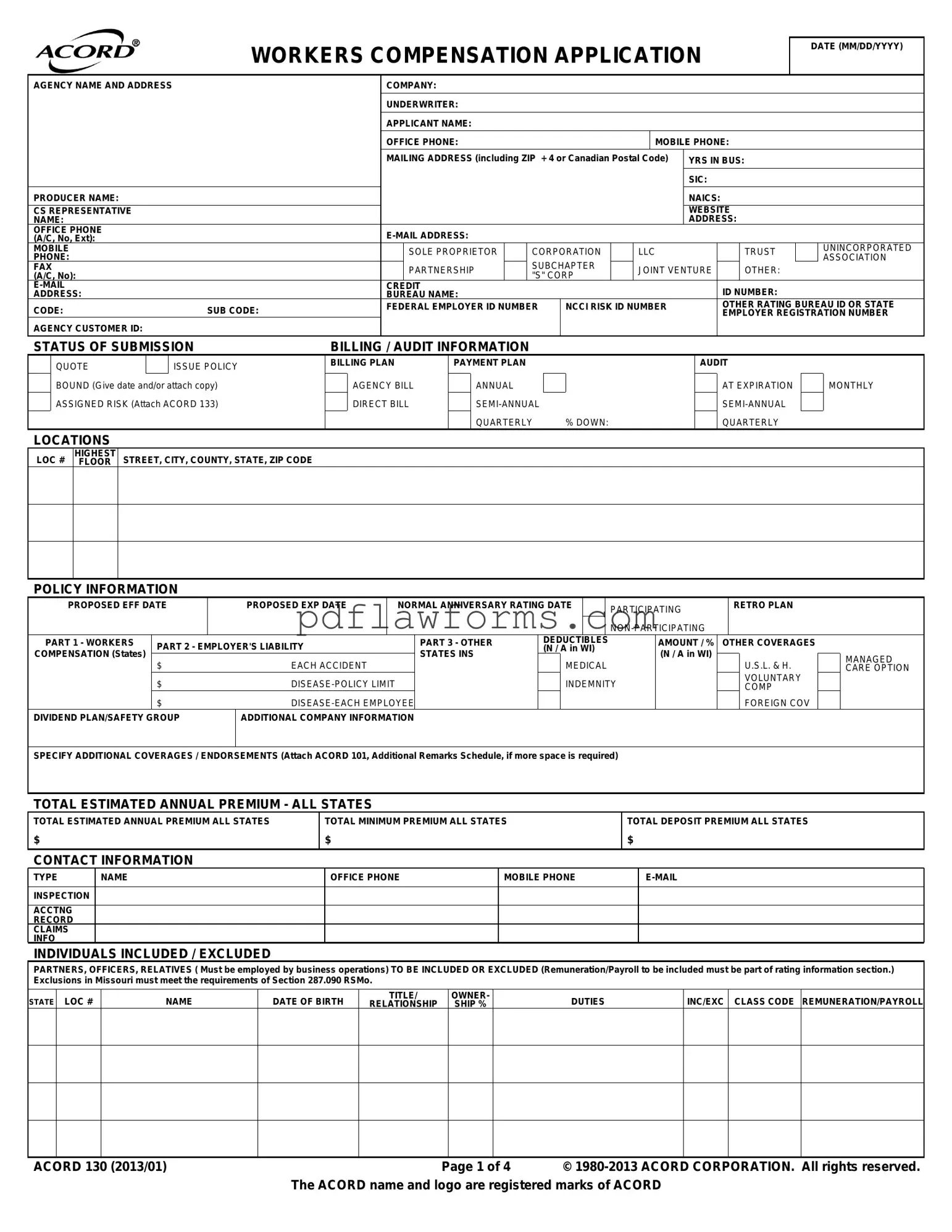

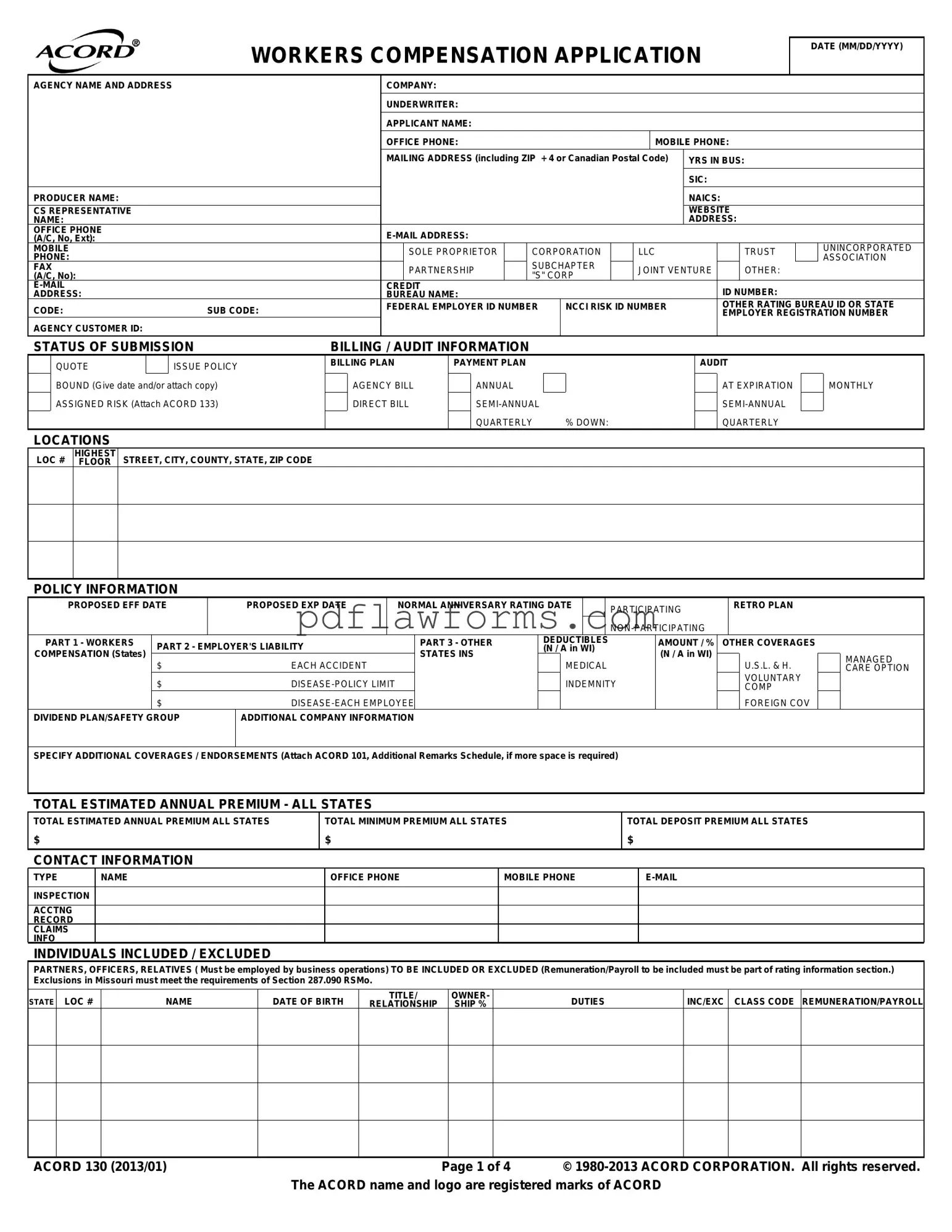

Filling out the ACORD 130 form can be a complex process, and errors may lead to delays or complications in obtaining workers' compensation coverage. One common mistake is failing to provide accurate contact information. This includes the applicant's name, office phone, and email address. Incomplete or incorrect details can hinder communication between the insurance agency and the applicant, potentially causing issues with policy processing.

Another frequent error is neglecting to specify the correct business structure. The form requires the applicant to indicate whether they are a sole proprietor, corporation, LLC, or other entity. Misclassification can affect the coverage options available and the premiums charged. It is essential to select the appropriate category to ensure that the policy aligns with the business's legal status.

Inaccurate reporting of payroll and remuneration is also a significant mistake. The estimated annual payroll must reflect the actual figures to ensure proper premium calculations. Underreporting payroll can lead to insufficient coverage, while overreporting may result in higher premiums than necessary. Both scenarios can have financial implications for the business.

People often overlook the importance of providing complete information about employees included or excluded from coverage. This section requires detailed information about partners, officers, and relatives employed by the business. Missing or incorrect entries can affect the risk assessment and, consequently, the premium rates.

Another common error involves failing to attach required documentation. For example, when indicating assigned risk, applicants must attach the ACORD 133 form. Not including necessary attachments can delay the application process and may result in the rejection of the submission.

Additionally, applicants sometimes fail to explain "yes" responses to specific questions. For instance, if the applicant has employees under 16 or over 60, this information should be elaborated upon. Omitting explanations can lead to misunderstandings about the business operations and potential risks.

Inaccurate classification of business activities can also pose problems. The form asks for a description of operations, including the nature of the business. Providing vague or misleading descriptions can lead to misclassification of risk, which may affect coverage options and premiums.

Finally, neglecting to review the form for accuracy before submission is a critical mistake. Errors in any section can lead to delays or complications in obtaining coverage. Taking the time to double-check all entries ensures that the application is complete and accurate, facilitating a smoother process.