Fill Your 4 Point Inspection Template

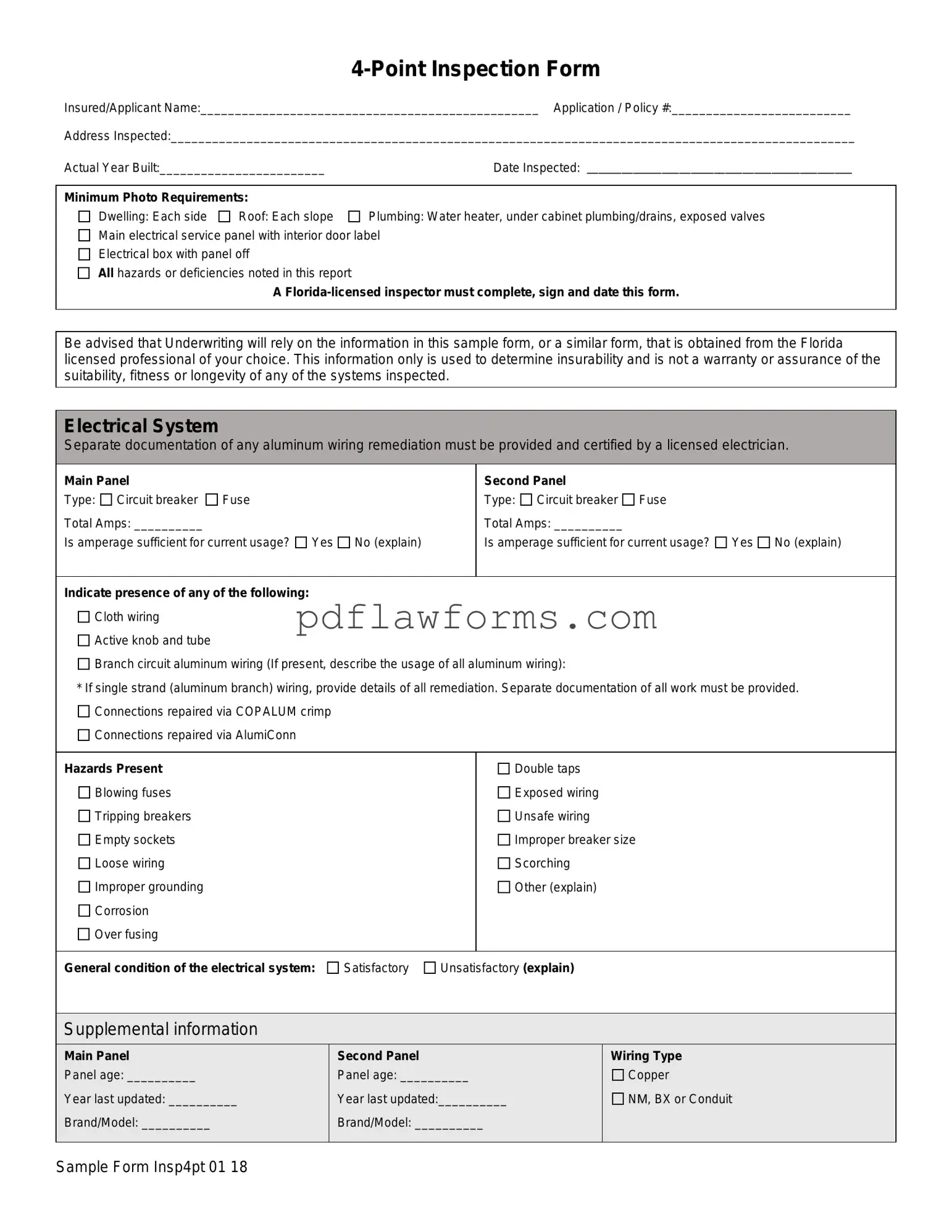

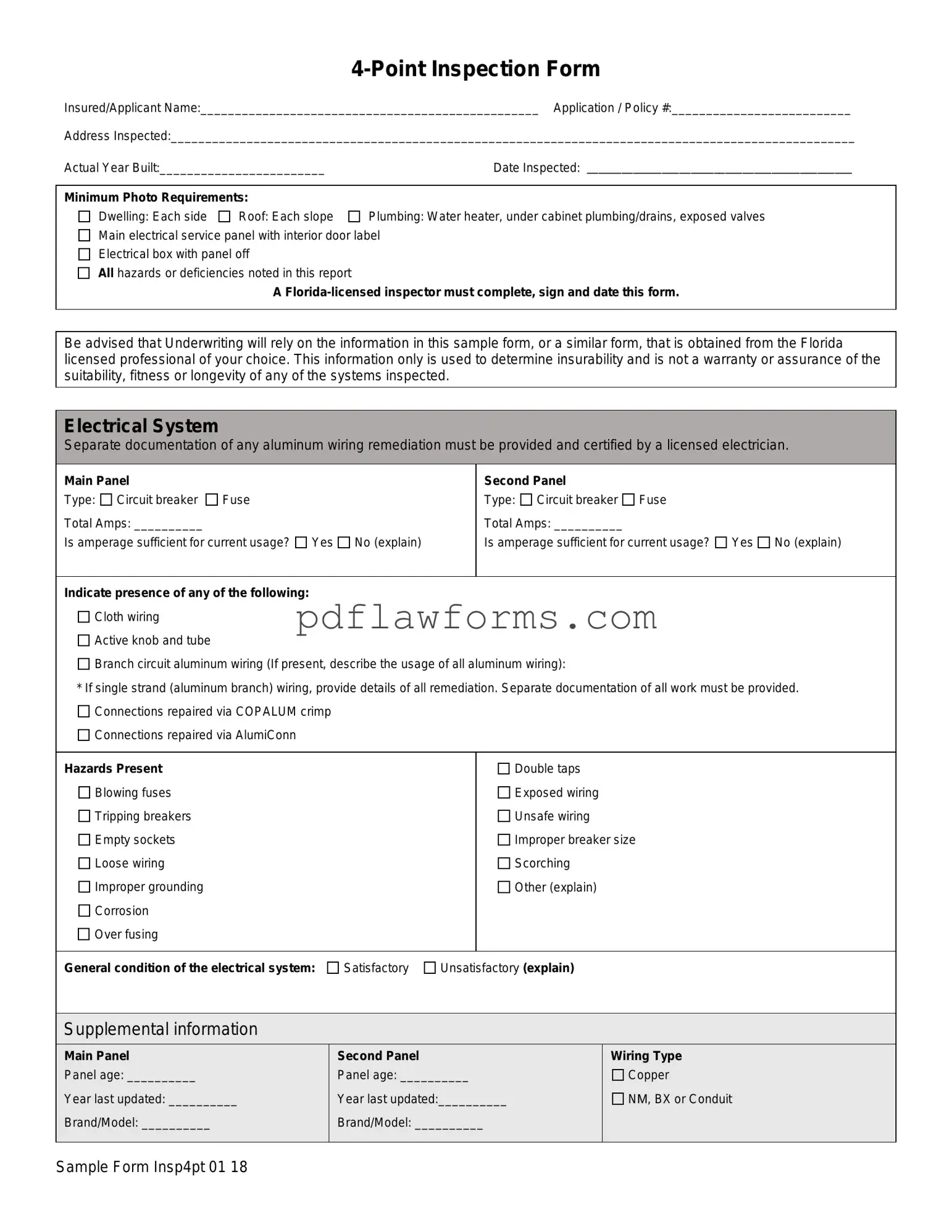

The 4 Point Inspection Form is a crucial document used to evaluate the condition of a property’s roof, electrical, HVAC, and plumbing systems. This form, completed by a licensed inspector, helps insurance companies assess the insurability of a home. It’s essential to gather accurate information and photos during the inspection to ensure a smooth underwriting process.

Ready to get started? Fill out the form by clicking the button below!

Make My Document Online

Fill Your 4 Point Inspection Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete 4 Point Inspection online, then download your file.

Make My Document Online

or

⇩ 4 Point Inspection PDF